Annuity Rate Comparison Before And After The Covid-19 Stock Market Plunge

See the difference in monthly incomes

Add Annuities To Your Retirement Portfolio

Many retirees have suffered a downturn in their mutual funds due to the big fall in the stock market recently.

But those retirees with government and also company pensions have an established income. The question for them now is whether they should annuitize their RRSP funds now or wait for the market to come back, if in fact it does. Either way, annuity payouts depend on a lot of factors and not solely on stock market performace.

An annuity provides a good income along with peace of mind. When you are retired you don't want to worry about stock market fluctuations; what you want is guaranteed income.

Key benefits of your annuity

- Guaranteed income for life

- No worries with stock market fluctuations

- No ongoing investment decisions

- Assuris guarantee - which provides 100% income protection to Canadian policyholders

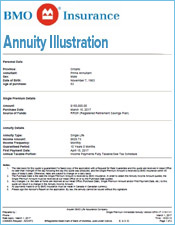

Annuity Rates Before And After Stock Market Plunge

| Before Stock Market Plunge | After Stock Market Plunge | After Stock Market Plunge | After Stock Market Plunge |

|---|---|---|---|

|

|

|

|

BMO Insurance

BMO Insurance

BMO Insurance

BMO Insurance  BMO Insurance

BMO Insurance  BMO Insurance

BMO Insurance