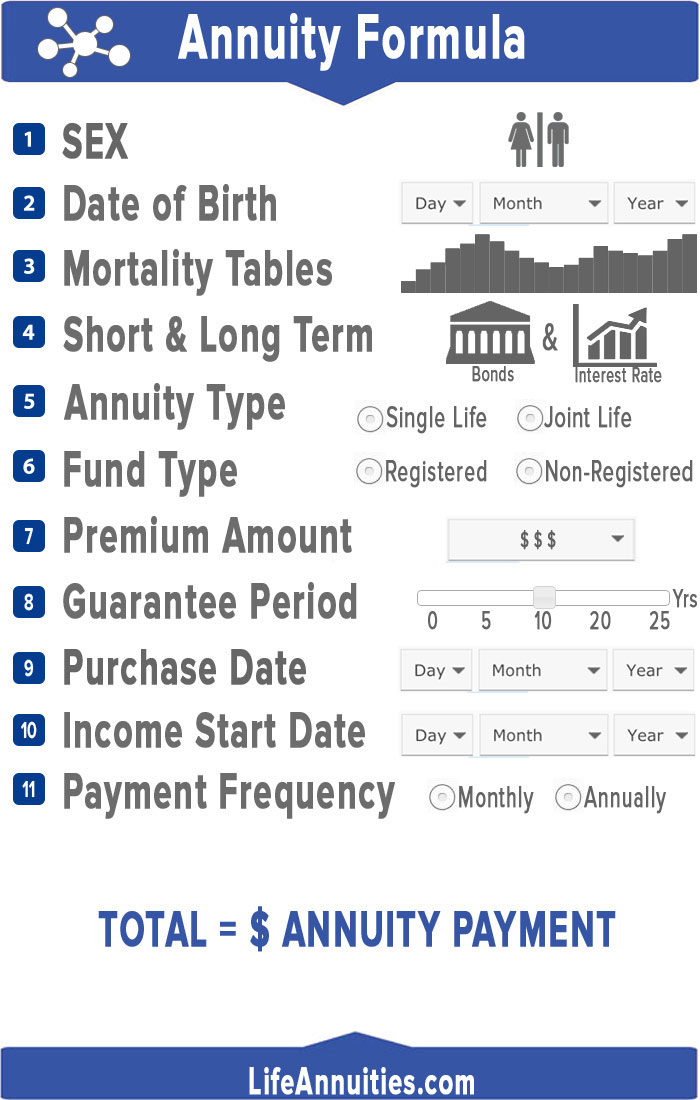

Annuity Formula (Infographic)

What is the annuity formula for calculating an annuity?

The Annuity Formula is based on:

- 1. Sex: the gender of the annuitant.

- 2. Date of Birth: the date of birth of the annuitant.

- 3. Mortality Tables: the life expectancy of the annuitant(s).

- 4. Short and long term bond rates.

- 5. Annuity Type: single or a joint life annuity.

- 6. Fund Type: the source of funds that are to be used to buy the annuity. This could be non-Registered or registered funds (RRSP, RRIF, RPP, Locked-in RRSP, DPSP)

- 7. Premium Amount: the amount of the single premium.

- 8. Guarantee Period Option: the guarantee period allows you to enter the number of years and months the annuity is guaranteed.

- 9. Purchase Date: when the insurance company can expect to receive the premium for the annuity.

- 10. Income Start Date: the date that the first annuity income payment is to be made.

- 11. Payment Frequency: the number of times per year the annuity is to be paid. Typically monthly or annual payments are made.

These are just some of the factors that actuaries use to determine how your life annuity income is calculated.