Impaired Annuity

An illness or disease that reduces your life expectancy

If you suffer from an illness or disease that reduces your life expectancy, you could qualify for an impaired annuity.

What is an Impaired Annuity?

In Canada, an impaired annuity refers to a type of annuity that is specifically designed for individuals with certain medical conditions or impaired life expectancy. It is also known as a medically underwritten annuity.

With an impaired annuity, the insurance company takes into account the individual's health condition and life expectancy when calculating the annuity payments. Since individuals with impaired health are expected to have a shorter life expectancy, the insurance company may potentially offer higher annuity payments compared to a standard annuity.

An impaired annuity is designed to provide individuals with higher income during their lifetime, taking into consideration their specific health circumstances. The amount of the annuity payments will depend on factors such as the severity of the medical condition, the individual's age, and the insurance company's underwriting guidelines.

It's important to note that impaired annuities are complex financial products, and individuals considering this option should seek advice from a qualified financial advisor or insurance professional who can provide personalized guidance based on their specific circumstances.

How is this Impairment Assessed?

To qualify for an impaired annuity, individuals typically need to provide medical evidence and undergo a medical evaluation to assess their health condition. The insurance company will use this information to determine the appropriate annuity rate.

The impairment value is the number of years added to your actual age. If, for example you are age 65 and the impairment value is 4, you will receive a monthly payment of a person aged 69.

Impaired Annuity Evidence

A detailed report from your doctor outlining medical history and present condition indicating that life expectancy is below normal.

What Type of Annuities Qualify?

- Life Annuities

- Single or Joint Annuitants

- Registered or Non-Registered Funds

Standard Life Annuity vs. Impaired Annuity

The following life annuity and impaired annuity rates are based on a male annuitant with $100,000 of non-registered funds with a no guarantee period. Age ratings typically range from 4 to 20 years. The impaired annuity table features a moderate +7 year rating. For exact rates for impaired annuities require underwriting which can be requested using our Impaired Annuity Form

Impaired Annuity Rates as of January 2026

| Male Age |

Standard Annuity Rates Monthly Income |

Impaired Age Rating (+7 years) |

Impaired Annuity Rate Monthly Income |

|---|---|---|---|

| 60 | $505.60 | 67 | $569.61 |

| 61 | $511.08 | 68 | $583.46 |

| 62 | $519.79 | 69 | $598.47 |

| 63 | $529.19 | 70 | $614.70 |

| 64 | $539.26 | 71 | $619.05 |

| 65 | $550.15 | 72 | $637.98 |

| 66 | $556.78 | 73 | $658.45 |

| 67 | $569.61 | 74 | $680.52 |

| 68 | $583.46 | 75 | $704.40 |

| 69 | $598.47 | 76 | $696.36 |

| 70 | $614.70 | 77 | $720.82 |

| 71 | $619.05 | 78 | $747.15 |

| 72 | $637.98 | 79 | $775.38 |

| 73 | $658.45 | 80 | $805.55 |

| 74 | $680.52 | 81 | $792.25 |

| 75 | $704.40 | 82 | $822.45 |

| 76 | $696.36 | 83 | $854.59 |

| 77 | $720.82 | 84 | $889.06 |

| 78 | $747.15 | 85 | $925.49 |

| 79 | $775.38 | 86 | $875.56 |

| 80 | $805.55 | 87 | $909.53 |

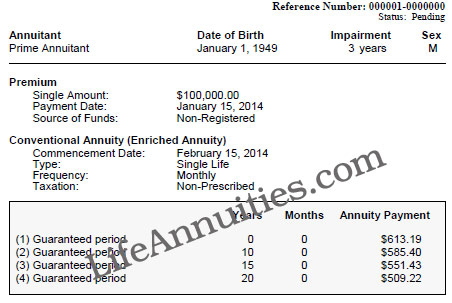

Sample of an Impaired Annuity Quote

Impaired Annuity Quote vs. Regular Annuity Quote

![]() Impaired Annuity PDF

Illustration

Impaired Annuity PDF

Illustration

vs

![]() Regular Annuity PDF Illustration

Regular Annuity PDF Illustration

Heath Impairments That May Qualify

- Cerebral vascular accident (stroke)

- Myocardial infarction (heart attack)

- Multiple Sclerosis ( M.S. )

- Dementia / Alzheimer's disease

- Paraplegia

- Cancer

- Parkinson’s disease

- Diabetes

- Aortic aneurysm

- Emphysema

- Cirrhosis of the liver

Impaired Annuity Calculator

Calculate your Impaired Annuity Quote

Get your Free, No Risk, No Obligation impaired annuity quote.