Annuity Taxation

Annuity Tax Rules and Information

How Are Annuities Taxed in Canada?

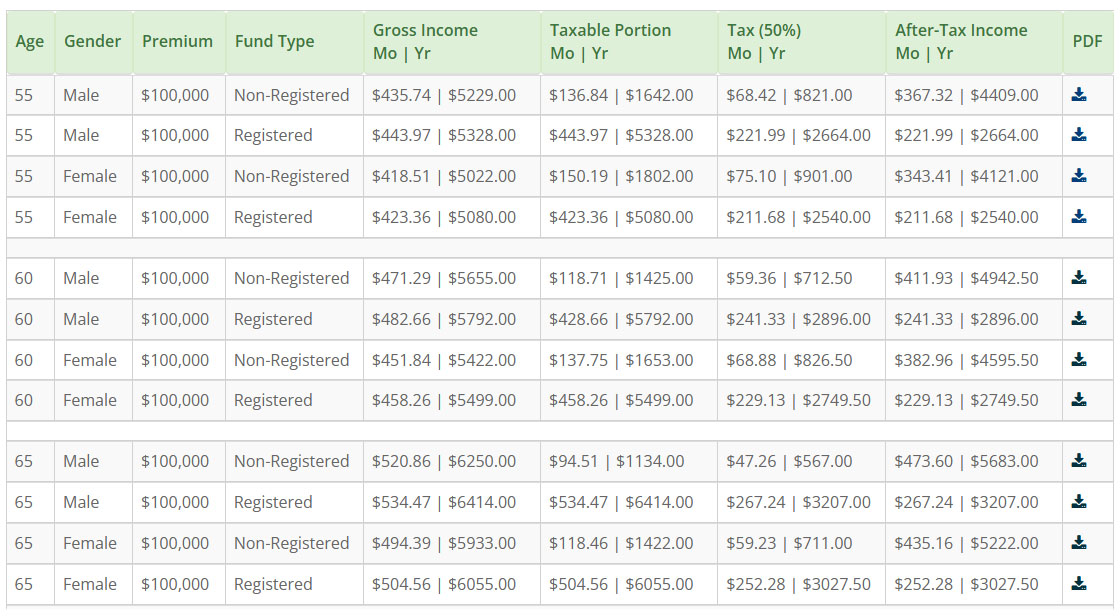

In Canada, both registered and non-registered annuities are subject to taxation, but they are taxed differently.

Income received from a registered annuity is 100% taxable to the policyholder in the year that it is received. On the other hand, only a portion of the income received from a non-registered annuity is taxable to the policyholder. The income received from a non-registered annuity can have prescribed or non-prescribed (accrual) tax treatment.

Portion of Annuity Payment Subject To Tax

- Registered / Pension Funds

- Non-Registered Funds

For annuities that are purchased with Registered or Pension funds, the income from the annuity is 100% taxable in the year that it is received.

For annuities that are purchased with Non-Registered funds, only the interest portion of the payment is taxable. In other words, only a portion of the payment is taxable in the year that it is received. Non-Registered annuities can either have prescribed or non-prescribed (accrual) taxation.

Prescribed & Non-Prescribed Annuities

- Non-Prescribed Annuities

- Prescribed Annuities

- The annuity must be non-registered

- The annuity may be a Single Life, Joint and Survivor Life or Term Certain Annuity

- Guarantee of payments may not exceed the annuitant’s 91st birthday

- Payments must commence no later than December 31st of the year after the purchase of the annuity

- For Term Certain Annuities, the owner and payee must be the same person

- For Life Annuities, the annuitant, owner and payee must be the same person

- The purchaser/annuitant must be an individual (not a corporation) or a specified trust

- Payments cannot be indexed

- How Are Annuities Taxed?

- Registered vs Non-Registered Taxation

- Prescribed Taxation

- Non-Prescribed (Accrual) Taxation

- Level Taxation

- Taxation During the Deferral Period

- Withholding Tax

- Mandatory Withholding Tax

- Optional Withholding Tax

- Taxation of Non-Residents

- Income Splitting

- Pension Income Tax Credit

- Avoiding OAS Clawback

- Potential Creditor Protection

Payments from a non-prescribed annuity are a blend of interest and capital. The interest element is taxed as it accrues; therefore the taxation will be higher in the early years of the annuity and decrease over the life of the contract as the capital is paid out.

Payments from a prescribed annuity are treated as a level blend of interest and capital. The interest element is taxed on a level basis spread out over the life of the contract.

An annuity must qualify for prescribed taxation when the following partial list of conditions are met:

Annuity Tax Brochure (Sun Life)

Annuity Tax Brochure (Sun Life) Annuity Tax Brochure (Standard Life)

Annuity Tax Brochure (Standard Life)