Leave A Legacy With An Annuity

What is a Lifetime Gift Annuity?

A lifetime gift annuity allows a grandparent to leave a legacy of a annual income to their grandchild, payable on the grandchild's birthday.

It is a joint life annuity between a grandparent and a grandchild who'll receive a lifetime payment every year, even after the granparent passes away. The granparent will leave behind a legacy contributing to their grandchilds future.

The lifetime gift annuity is not restricted to grandparents; a parent may also purchase a lifetime gift annuity for a child.

Sun Life's Lifetime Gift Annuity - Brochure

Overview of a Lifetime Gift Annuity

| Lifetime Gift Annuity | Annuity Details |

|---|---|

| Annuity type | Joint life annuity |

| Source of premium | Non-registered funds only |

| Tax treatment | Accrual |

| Policyholder (and taxpayer) | Parent, Grandparent, Aunt, Uncle etc. |

| Contingent policyholder | Child, Grandchild, Niece, Nephew, etc. |

| Annuitants | Parent = Annuitant Child = Joint annuitant |

| Payee | Parent or Child* *We advise against naming a minor joint annuitant as a payee. |

| Payment frequency | Annual |

| Payment date | Child's birthday (or date of policyholder's choice) |

| Payment start date | The start of income may be deferred up to 10 years from the purchase date. |

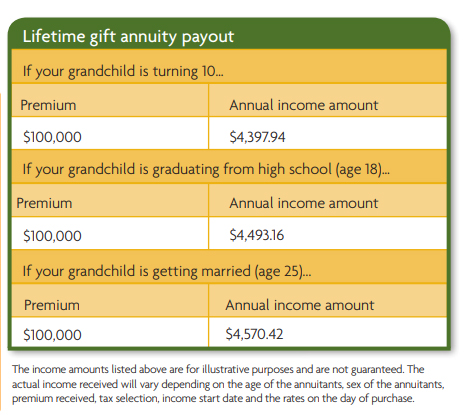

Annuity Payout For A Lifetime Gift Annuity

Lifetime Gift Annuity Quote

| Overview | Annuity Details |

|---|---|

| Annuitant: | Father |

| Date of birth: | 12/09/1957 |

| Sex: | Male |

| Joint annuitant: | Son |

| Date of birth: | 01/01/2004 |

| Sex: | Male |

| Total premium: | $100,000.00 |

| Annuity type: | Life |

| Guaranteed period: | 0 years |

| Purchase date: | 01/11/2013 |

| Income start date: | 01/11/2014 |

| Non-registered tax type: | Accrual |

| Income frequency: | Annual |

| Results | |

| Total income: | $4,137.62 |

Lifetime Gift Annuity Form

Complete our Lifetime Gift Annuity Form and we'll provide you with a quote and help you set up this meaningful legacy gift.