RRIF: Registered Retirement Income Fund

What is a RRIF?

As with other plan types, RRIF’s are holding containers in which you might put a wide variety of investments, from term deposits and mutual funds to Exchange Traded Funds (ETFs), real estate, stocks, bonds and options. However, do note that the Canada Revenue Agency (CRA) only allows qualified investments in your RRSP or RRIF.

A person becomes the new owner of a sparkling, brand-new RRIF account by opting to rollover their RRSP plan into a RRIF.

CONTENTS

- All About RRIFs

- Qualified vs. Prohibited Investments

- How does a RRIF work?

- Retirement! Converting your RRSP into a RRIF

- Capital Exhaustion and Longevity Risk

- RRIF Withdrawal Calculator

- Advantages of a RRIF

- Limitations of a RRIF

- When "must" an RRSP be converted to a RRIF?

- What about Locked In RRSPs? Can they be converted to RRIFs?

- RRIF vs. Annuity

- Types of Annuities

- Moving a RRIF from one bank to another financial institution

- Death of a RRIF Holder

- FAQ

- Conclusion

- RRIF Form

All about RRIFs

A Registered Retirement Income Fund (RRIF) shares many similarities with its close relative, the Registered Retirement Savings Plan (RRSP). In fact, they are two sides of the same coin. We all know that an RRSP is designed to be the holding account, or vehicle, for your retirement investments as you accumulate funds in the plan during your working years. Eventually, and depending on the performance of your investments in the plan, all your tax deferred contributions will grow and compound over the years, and you will eventually want to get paid by your RRSP.

Usually, but not always, this is when you decide to “retire” and begin to rely on RRIF income along with other sources of retirement income to make your ends meet and live your golden-years lifestyle. So, as soon as you switch gears from accumulation to de-accumulation, that is precisely when you should switch your RRSP plan type to a RRIF. While you are pondering how much money you could receive from your amazing RRIF portfolio, it is worth noting that such a plan-type switch is permanent. As we’ll discuss shortly, everyone’s retirement plans are likely to have some unique quirks, and there are lots of ways to make these plans meet your specific goals.

Although RRIFs might seem inflexible, plan types which force you to take various minimum payments on a schedule (true!), there are many still incredible features and characteristics to these plans that you definitely want to know about ahead of time.

Qualified vs. Prohibited Investments

| Investment | Explanation |

|---|---|

| Qualified Investments |

If a given security trades on at least one exchange that Canada's Finance Department considers a Designated Stock Exchange, it will be recognized as a qualified investment. Here are 5 popular global exchanges out of 46 as of 2024

All major product types sold by Canadian financial institutions such as Gauranteed Investment Certificates, Mutual Funds, Exchange Traded Funds and almost any managed portfolio comprising typical stocks, bonds, options, commodities and futures would also generally be eligible as well. |

| Prohibited Investments |

Any debt of the controlling individual of the plan (RRIF annuitant) Any debt or share of, or an interest in, a corporation, trust or partnership in which the controlling individual has a significant interest. Any debt or share of, or an interest in, a person or partnership with which the controlling individual does not deal at arm’s length. Any interest (or for civil law a right) in, or a right to acquire, a

debt, share or interest described in any of the preceding bullets |

How does a RRIF work?

A RRIF can be thought of as a pension that you manage yourself. Where a traditional defined benefit plan offers a “guaranteed” fixed income amount to placeholders each year, RRIF holders are responsible for the investment mix that generates their return, as well as important choices such as when to rollover some or all of their RRSPs into a RRIF.

Other than that they are strictly de-accumulation plans, RRIFs are broadly similar to TFSAs, RRSPs and other plans. In fact, the decision to rollover from an RRSP plan to a RRIF does not require the selling of any investments or securities within the plan. This is good news!

As we’ve emphasized elsewhere with other plan types, the success of any RRIF owner depends dramatically on whether they stick to the basics of having a well-considered mix of investments to provide them with the return and compounding over the long term.

Some new RRIF owners ask questions such as….will my money last as long as I do? How much money do I need to have? What happens if the RRIF minimum payment is greater than the investment return I receive in my portfolio?

These are great questions, by the way, and we’ll aim to answer all of them here today!

Retirement! Converting your RRSP into a RRIF

As we’ve discussed above, you can convert your RRIF at almost any age you wish as long as it’s before age 71. And, as you might guess from working through that formula we introduced earlier, the minimum mandatory income you must draw from your RRIF rises as you age. In fact, by the time Canadians get into their 90s,

At this age, the minimum payout percentage is 4% of the initial plan value. Some Canadians feel that they don’t actually require this income at this time, and some even continue to work well into their 70s. In which case, they may wish to continue to keep their RRSP plans open to continue to receive 18% of their earned income over those years. However, eventually you must start drawing down your retirement savings, even if you continue to work, volunteer, travel full time or do a million other things with your time. RRSP’s must convert into Registered Retirement Income Funds, or RRIFs, by age 71, with your first withdrawal happening at age 72.

The following table is a summary of some key dates along the minimum RRIF withdrawal journey, showcasing how much additional income (from the starting plan value in that year) must be withdrawn as plan participants age. Remember, no tax is withheld on the minimum amounts withdrawn, although regular RRSP-style withholding taxes do apply on any amounts above these minimums per month. Clients are advised to talk to their advisor and setup their RRIF to fit their life and goals. Statutory minimums don’t necessarily fit every client situation, and if it makes sense to withdraw more and it suits your financial plan, don’t worry about the minimums.

Converting Your RRSP Into A RRIF

| Age Start of Year | RRIF Minimum Payout Percentage | Approximate Monthly Income $250,000 Portfolio | Approximate Monthly Income $500,000 Portfolio |

|---|---|---|---|

| 65 | 4% | $833 | $1,666 |

| 70 | 5% | $1,041 | $2,083 |

| 75 | 5.82% | $1,212 | $2,425 |

| 80 | 6.82% | $1,420 | $2,842 |

| 85 | 8.51% | $1,773 | $3,545 |

| 90 | 11.92% | $2,483 | $4,967 |

| 95 | 20% | $4,167 | $8,333 |

| This example is a simplification, and uses assumptions. Each year, RRIF minimums are updated by the government and may vary over time, the monthly income totals are estimates and may be incorrect. It is recommended that clients consult their financial and tax advisors to ensure they receive advice that is tailored to their situation. | |||

Generally speaking, it is difficult for most RRIF plans to achieve consistent returns above 8.51%, even with a highly aggressive (100% equity) asset mix. The expectation is that these plans deplete close to when annuitants achieve their life expectancy - and to provide extra income in the event that additional living and care costs are incurred in one's late 80s and 90s.

Ensure your Retirement Income Plan deals with Capital Exhaustion and Longevity Risk

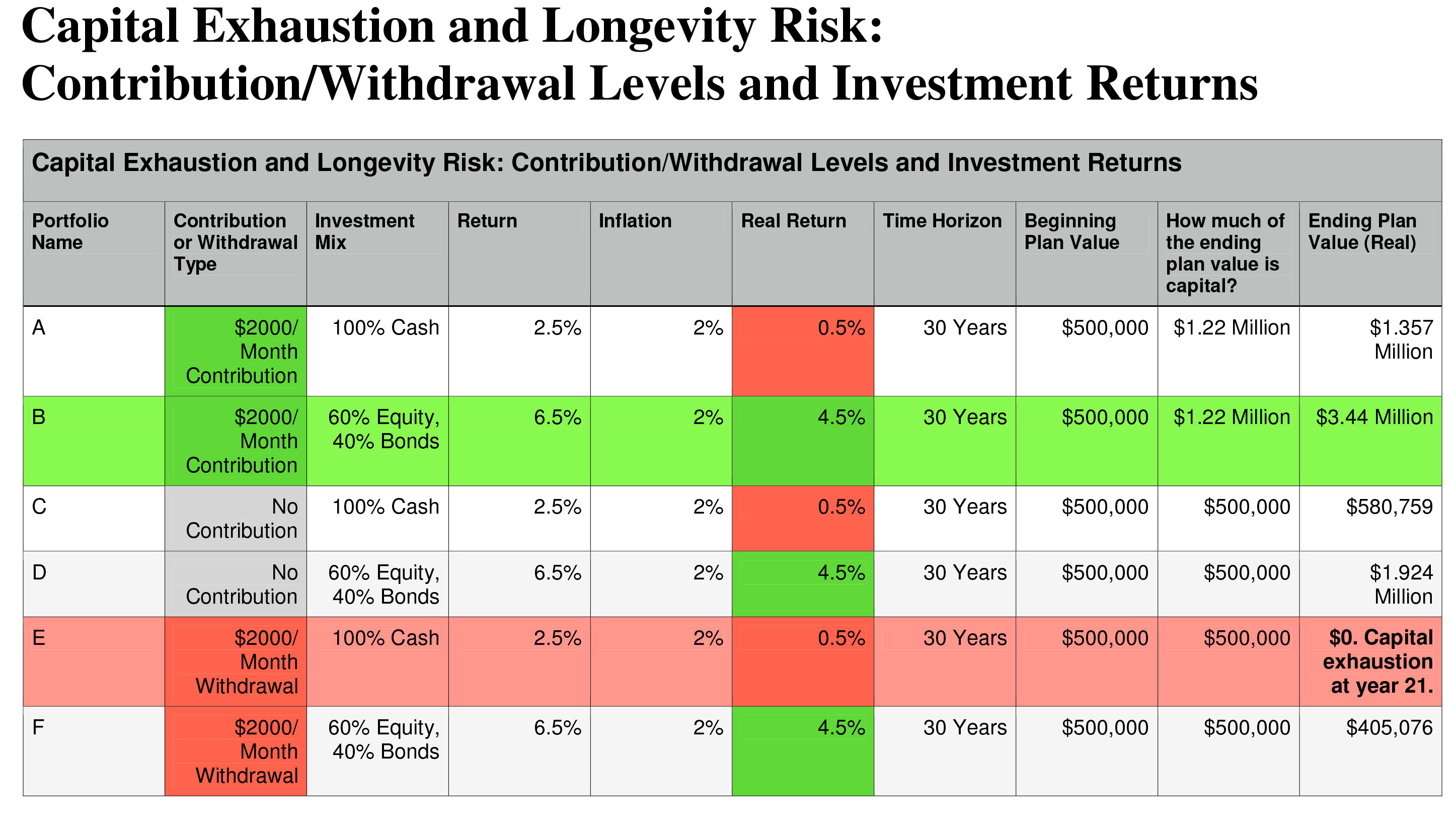

Why is it important to continue to “invest” while withdrawing from a RRIF? Let’s consider the example of two investors who both retire at age 71. Well, let’s consider six scenarios so we can consider the impact of contributions, withdrawals, and various investment returns.

What lessons can we draw from this handy, dandy chart? In essence, happy portfolios have both regular contributions and generous compounding rates due to their asset mix. The worst performing portfolios have both regular withdrawals and low rates of returns.

The RRIF retirees at the highest risk of capital exhaustion and longevity risk are those with regular withdrawals and low rates of return. We point with astonishment to portfolio “E” vs. “F”. Both portfolios must pay $2,000 per month, and yet, owing to the offsetting influence of that 4.5% compounding rate, portfolio F is only modestly below its starting value of $500,000. Portfolio E has become fully exhausted at 21 years into its withdrawal life. If this portfolio belonged to a person who retired at age 65, they would suffer the complete loss of this income source at age 86. What if they continued to live until age 95 or 100? That’s a long time to go without that $2,000 paycheque in their retirement lifestyle.

What’s the lesson here? Ensure your portfolio is diversified and strikes the right balance between capital preservation while ideally having some capital growth potential. Although inflation is extremely low at the present moment, it is not nonexistent. Inflation eats up 80% of the return of the “cash” investor (2/2.5), and only 30.7% of the more “balanced” asset mix investor (2/6.5).

RRIF Withdrawal Calculator

Use our RRIF Withdrawal Calculator to help you determine your minimum amount this year.This is the minimum amount you are required by the government to take into income which is based on your present age.AS the minimum percentage increases each year,you should make every effort to see that the remaining balance grows as much as possible.A good targetwould be to replace the amount you have to take this year.

Advantages of a RRIF

What are some advantages of an RRIF? Plenty!

- You can convert to a RRIF early.

- You can have multiple RRIFs.

- You can have a partial RRIF.

- You can base your RRIF minimum on your spouse’s age instead of yours.

- You can take advantage of RRSP contributions in the rollover year you turn 71 too.

You can actually make this election to convert at a fabulously young age. Many devotees of the Financial Independence, Retire Early (FIRE) philosophy might be thrilled with the notion of converting their (hopefully) generous RRSP portfolios into RRIFs at the ripe old age of 29, and then living off the proceeds for the ensuing 50-60 years of their lifespan.

The downside to this early conversion is that you do have to start paying yourself something from your RRIF.

In our extreme example of a wealthy 29-year old who retires, they would be required to withdraw (1/90-age, or 1/90-29 = 1.64%) from their RRIF. So, if they had wisely saved and invested extremely well, they would need to ensure that their average rate of return in the decades to come was sufficient to offset this gradually increasing RRIF minimum withdrawal rate.

There’s no limit to the amount of RRIF accounts you can establish from your prior RRSP plans. Sometimes, it might be useful for some clients to organize their asset mix differently across different plans. Perhaps one RRIF could be self-managed, and another would be managed with an advisor. The downside of multiple plan types is computations for minimum annual withdrawals can become more complex.

Imagine that you had $500,000 in your RRSP and you were 60 years old. Perhaps you had a plan to semi-retire at this age, and then potentially work part time for some deserving non-profits in your mid to late 60s. Not every persons retirement is linear involving a distinct break between “working” and “retired”. Second careers are not uncommon, and it is also not uncommon to work with some uncertainty about what ones future plans might hold. In this clients scenario, with a need for “some” income from ages 60-65, it might make sense to convert $100,000 of your RRSP into a RRIF at age 60, and leave the remaining $400,000 RRSP portfolio to continue growing and to receive some smaller additional RRSP contributions in years 65-71. Every person’s retirement is unique, and personalized planning is essential.

This can be a valuable tactic for those clients who do not necessarily need income from their RRIF and would prefer to defer amounts until later years. By electing to use the age of a younger spouse, less income is received in the current tax year, allowing more funds to compound and grow for later use.

Often clients neglect to make eligible contributions in the year that they turn 71. Imagine a client that earns $50,000 of employment income in the tax year in which they turn 71. They are eligible to contribute $50,000 x 0.18 = $9,000 into their RRSP, and yet, they will not officially receive this eligible RRSP room on their Notice of Assessment until it is too late - March of the year they are 72. In these circumstances, it is often best to over-contribute to their RRSP. Individuals are allowed to over-contribute $2,000 into their RRSPs without any penalty, while additional amounts are assessed a penalty of 1% per month. Given that this penalty will only be assessed for a very brief time before the CRA issues additional RRSP room ($9,000), this small penalty is generally worth paying in order to take advantage of that additional tax deferral.

Limitations of a RRIF

- Be conscious of attribution rules for spousal RRSP contributions

- Withholding tax details

- 10% tax is withheld up to the first $5,000

- 20% tax is withheld for amounts between $5,001 and $15,000

- 30% tax is withheld for withdrawals over $15,000.

While spousal RRSP contributions are an important perk for couples with significant differences in earnings during their working years, these benefits pose complexities or RRIF withdrawals. Essentially, it is important to be conscious of the CRA’s attribution rules. A spousal RRSP with any other institution in the same year, or any of the prior two years, can be attributed to income back to the original contributor. That can mean some pretty major tax issues if you are not careful. However, do keep in mind that the attribution applies only to amounts that are in excess of the minimum income amount – you can still withdraw the minimum amount without issue.

As we’ve reviewed here, RRSP and RRIF plan types are more similar than they are different. All withdrawals from both RRSPs and RRIFs are taxable. RRIFs are subtly different in that they come with an automatic minimum schedule (e.g. 1/90-age = minimum annual income based on prior years closing balance) that must be paid out. This “must pay” amount is then reflected on your “T4RIF” statement which is then included with your other taxable income evidence when you file your taxes. However, what if you decide to take more than the minimum. In these scenarios, because these withdrawal amounts are not planned for in advance, your RRIF holder must apply the normal withholding tax rates that apply to any additional RRSP/RRIF withdrawals at source.

The schedule on these withdrawals is as follows:

Ultimately, the withholding tax policy is there to ensure that the CRA receives some tax revenue on amounts received, even if it isn’t the correct actual amount of tax when all income and deductions for that tax year is considered. The correct amount of actual tax due will only be revealed once a taxpayer files their taxes in the year subsequent to any additional RRSP/RRIF withdrawals. In many instances, the amount of tax withheld at source was more than what that taxpayer was actually due to remit – leading to the annoyance of having the CRA hold your money interest free for the period of time from the date of tax withheld to your eventual tax refund date. Remember, tax refunds are not always strictly good news. Often they are evidence that the government has held some of your money interest free for an (often avoidable) period of time.

How can withholding taxes be avoided? The best method is to simply plan with your RRIF holder ahead of time for the cash flow that you really need for the years to come. Sometimes the minimum income is just not enough to make ends meet. It’s always worthwhile to revisit your budget in retirement, plan ahead of time for those pesky expenses that can pop up from time to time, and then establish a RRIF payout schedule at a payout percentage that meets those needs. Your RRIF is there to meet your needs at the end of the day. That said, it is important to weigh all the impacts of these decisions. Will an increased payment schedule has overly impact capital exhaustion and longevity risks (see portfolio E above)? By establishing your RRIF minimum payout in advance, your RRIF provider can pay you more income per month, and reduce the likelihood of needing to raid your RRIF on an intermittent basis to top up your income.

When “must” an RRSP be converted to a RRIF?

Converting to an RRIF will subject you to the minimum income rules but you do not have to start income until the year you turn 72. Technically, at 71, your minimum income is $0 because there was no value to the RRIF at the end of the previous calendar year.

What about Locked In RRSPs? Can they be converted to RRIFs?

In short, yes! A locked-in RRSP is a plan containing funds transferred from an RPP for a member of the Registered Pension Plan (RPP). Essentially, the converted “RRIF” plan must also follow the same rules of the original RPP. These locked-in RRIFs are sometimes called “life income funds” or locked-in “retirement income funds.” Your employer or pension plan administrator can answer any questions you have about locked-in funds. LIRAs and locked-in RRIFs are taxed in the same manner as regular RRSPs and RRIFs, and must issue minimum payments to annuitants in the same manner as conventional RRIFs.

RRIF vs. Annuity

One of the largest themes that always lurk beneath retirement income conversations is an unspoken fear of the unknown. When we are young, the promise of markets can seem exciting. Stock market corrections and crashes are wonderful for the portfolio builder – after all, they allow us to purchase of the future at a discount, to borrow the words of Warren Buffet. Our mindset inevitably changes as we age and our portfolio increases in size. Even relatively common, mild, intra-year corrections of 10% can seem unsettling as your RRIF portfolio heads north of $250,000 or $500,000 in size. We’re now talking about $25,000 and $50,000 dips in value, often occurring in a relatively short period of time, and just as often, breathlessly accompanied by some level of sensationalist media coverage.

Our advisor may tell us that these dips in value are normal, and to be expected. They are almost certainly correct, and yet the emotional willingness of the investor to weather these dips in their portfolio may wane over time. One of the most crucial aspects of investing is the “risk tolerance” piece. Just what level of decline in one’s portfolio are investors comfortable with? Sometimes it’s less than we might think, and it’s the job of our advisors and ourselves to be open, honest and frank about all of this, and to make sure our portfolio is well aligned with our risk tolerance and our long-term needs. Sometimes these two aspects are in open conflict. We want those higher returns, but we also know that there a limited amount of downside risk we can stomach.

It is in these types of challenging scenarios where the “ballast” part of your portfolio comes into play. Traditionally, this is where advisors recommend a diversified fixed income portion – usually anywhere from 20% to 80%, depending on the client’s long-term return objectives and time horizon. Yes, bonds pay less, and they certainly pay less in our current market environment, but that’s not their main value. The primary utility of having ballast in your portfolio is to have some securities that don’t lose value when everything else is going into the kitchen sink. It is in this conversation that annuities can also play an important role.

Where a fixed income portfolio provides an more risk-averse investor with relative security of principal, reasonable liquidity, and a fairly high level of confidence in generating future income (via coupons), annuities approach things from a different angle. Being that they are insurance contracts, the investor essentially exchanges all the principal involved in the annuity contract with a promise-to-pay from the insurance company for a future period of time. So, ownership of the principal (and it’s liquidity) are gone, but we now have a promise of future expected payments. For the retiree, this exchange can seem quite compelling. The whole point of having a RRIF portfolio with a basket of securities is the hope that this basket of securities can pay us income for many years. There is no guarantee, however, that it will.

Annuities, therefore, can play a role in this retirement income conversation, allowing the investor to ramp up certainty about their future income at the cost of (typically) future portfolio value and liquidity. Why do we say that annuity investors are potentially giving up some value with a purchase? Frankly, because there is no “free lunch” with the annuity vs. conventional investment portfolio decision. Whenever an investor purchases a product from an insurance company, or any company, it’s always worth asking: how can the insurance company offer this product and still make money?

The insurance company is willing to sell clients annuities because they can manage their payment obligation risks with the high probability that an equivalent portfolio of securities can generate enough of a return to both meet the payment obligations on the annuity schedule, and create a leftover profit for the company. They are aware that although equity markets feature significant return volatility over the short term, they also feature a very high probability of a positive return over 10 or more years. Indeed, there are vanishingly few periods of time in history where the S&P500 hasn’t made money for 10 years. The same is true for the Toronto Stock Exchange (TSX), as well as most developed world security indices for that matter.

Equities markets are highly volatile and risky over the short-term only. Over the long term, patient investors are likely to recoup the benefits of both high probability of a positive return and high probability of a higher real return (relative to fixed income or annuity alternatives). However, these gains can only be realized by the patient and the disciplined. Investors that are wavering are best advised to consider annuities and/or fixed income in order to ensure their downside-risk tolerance is not being exceeded by their current portfolio. The potential of future higher returns is useless if RRIF investors continually panic and sell off their funds at the bottom of a market crash or correction.

Types of Annuities

Above, we introduced the idea of a single person exchanging a portfolio of a certain value for a promise from an insurance to pay a fixed monthly income for a certain period of time. This single annuity contract typically provides owners with a stream of payments until they pass away. Is this a good deal or a bad deal? The answer depends on how long you actually live, and the uncertain opportunity cost of the future income you could have earned on your old RRIF portfolio of securities.

If you expect to live a below-average lifespan, and are a fairly risk-tolerant investor, your opportunity cost could be quite high: the alternative of investing in a diversified portfolio of securities with a relatively seamless estate-planning transition to successors or beneficiaries may be the better option. If on the other hand, you expect to live a long time, and your alternative is investing in a highly secure portfolio of term deposits and low-yielding investment grade bonds, perhaps the annuity is a great choice: offering you higher income than you would otherwise have had, and removing the anxiety of outliving one’s capital (as in portfolio E in our example above).

There are other flavours of annuities that we should consider. In the above example, we implicitly have assumed nominal annuity income. An insurance contract that promises you a stream of income, let’s say $2,000 a month, is actually a promise to gradually pay less over time. Remember that inflation should generally be assumed in all financial planning scenarios, and often at a low level of 2-3%. Nonetheless, receiving 2-3% less from your annuity every year adds up over time. A $2000 payment in 2025 only buys $1,320 worth of goods and services in 2031 assuming 3% inflation. What’s a potential answer? Indexed annuities of course. Indexed annuities, while likely costing more than traditional single life annuities, can help defray inflationary impacts on your monthly income.

What if you want an annuity strategy that encompasses your partner or loved one? There are many options here as well, including joint and survivor annuities. As you might expect, these annuities are designed to provide income that continues past the death of the first beneficiary, allowing the survivor to receive a continuing income until they also pass. Typically, the monthly income amount is reduced after the first death. These features can all be tailored and often modified in advance, and often buyers intuitively recognize that survivors won’t need as much income to support their living needs. Expect to pay a premium for any feature that can reasonably expect to boost the payment obligations for the insurance company.

In this respect, many annuity buyers object to the loss of estate transmissible value in the event of premature death. Insurance companies are often quick to engineer new variations of products to meet any perceived deficiencies in their product lineups. Annuities with some version of an inheritance clause offer their customers the benefit of a death benefit guarantee. If you purchase an investment for $500,000 with death benefit guarantees, and you pass away early in the life of the annuity payment schedule after only receiving $100,000 worth of payments, your heirs and beneficiaries could then receive the difference of $400,000.

As above, however, check over the fine print and review the pros and cons with a qualified advisor. Often these death benefit guarantees are not indexed to inflation. Nominal death benefit amounts received in the future will generally be less valuable than the value of your portfolio in the present, due to the impact of inflation and the opportunity-cost of foregone investment returns.

Moving a RRIF from one bank to another financial institution

Unhappy with your current RRIF provider? Just as with other registered plan accounts, there’s nothing that requires you to stick to your current financial institution. However, before you complete the paperwork, it’s worth doing a little bit of due diligence on the transfer process itself. Are there fees that will be charged by your old financial institution to send your account to the new one? If you have a locked in plan, do you know what jurisdiction applies in the case of the governing pension legislation?

Often your new plan holder will cover some fees charged by the sending institution, but it’s best to get all of these details organized in advance, in writing if at all possible. Moreover, are you transferring your current basket of investments “in cash” or “in kind”? Can your receiving institution hold the exact securities that your old one could? Can they cover some of the transfer costs levied by the sending RRIF institution?

The best advice is that measuring twice and cutting once is wise here. It doesn’t hurt to call both institutions to double check that both sending and receiving institutions can hold the exact same series of funds and securities that you hold. If they cannot, you may be required to sell some of these securities. For these types of securities that have been sold into cash, as well as in situations where you are liquidating your holdings and going into cash to make things simple, be aware that there may be an opportunity cost to being in cash for the transfer timeline. If markets head rapidly higher while your funds are in limbo between institutions, you may feel frustration that you are missing out on this growth.

A best practice is to move your portfolio in-kind where possible, and to ensure that you know all of the fees involved well in advance. Be especially careful of mutual funds sold with a back-end load, otherwise known as “deferred sales charge” (DSC). RRIF fundholders that dispose of these funds through a transfer process “in cash” may unknowingly trigger large early-payment penalties related to those back-end commissions. Sometimes these fees get charged simply because the receiving institution cannot hold the precise ‘series’ of mutual fund units that you have. In any kind of in-kind transfer situation, double checking on transfer fees and the list of eligible transferrable securities can save a lot of headache later.

Death of a RRIF holder

Although not the most pleasant topic in the world, the reality is, none of us known when we will pass away, and it is always best to be prepared. Part of this important preparation work is ensuring that beneficiaries and successor-annuitants are established for all of one’s registered plans, and this certainly includes RRIF accounts.

As with other registered plan types, if you name your spouse/partner as the beneficiary, upon passing the plan will move to the spouse without a hefty tax bill. Of course, if the survivor is over 71 years old, the plan must be transferred to an equivalent type plan – like a RRIF to a RRIF.

If, on the other hand, the surviving spouse is less than 71, the RRIF can be converted back to an RRSP. At the time of RRIF rollover application, you can also designate the beneficiary as a successor annuitant, which means the payments will simply continue onto the surviving spouse without any liquidation of assets.

Unless the beneficiary is under 18, any beneficiary other than the spouse will cause the entire value of the RRIF to be collapsed and treated as taxable income to the estate.

RRIF Frequently Asked Questions (FAQs)

- When do I buy a RRIF?

The year in which you turn 71 is D-Day for the protection of your savings as this year you must decide how to take your retirement income. - Do you deposit cash into a RRIF?

No, you cannot make deposits into a RRIF which is created by transfers from a RRSP. - What happens if there is money in the RRIF when I die?

Usually it is transferred to the RRSP or RRIF of a partner. Alternatively, the whole sum can be taxed and the balance distributed to the heirs. - Am I limited in investment types for my RRIF?

No. Normally used investments are mutual funds, segregated funds, ETF's etc. - I want to use different investments, can I have multiple RRIF's?

You can have as many RRIF's as you like. But the more you have the more you have to look after, so be careful. - Are RRIF / TFSA transfers possible?

No, all you can do here is to use your RRIF payments to make TFSA deposits. Your RRIF payments are of course, fully taxable. - We supply you with the best RRIF interest rates and other eligible investments in Canada as our brokers represent all the best financial institutions in Canada. For personal assistance for your RRIF, please use our RRIF Form.

Conclusions

In conclusion, RRIFs are the amazing second-life of your RRSP account. Oftentimes, the rollover moment is a crucial moment of truth, where all your long-term retirement planning and portfolio building activities come to a head. It’s a point of no return, depending on whether you are partially RRIF’ing your portfolio, or whether you’ve reached age 71 and must make the rollover.

In most scenarios, these weighty decisions should be made in tandem with some careful planning and de-accumulation modelling with your financial advisor. Whether you have purchased an annuity with some or all of your RRIF proceeds, or are letting a well-diversified portfolio work for you over time, it will be important to have a well-developed retirement income plan to help you have confidence in your entire retirement paycheque.

We hope this article has reinforced the importance of careful planning for the de-accumulation phase of your hard-earned retirement nest egg. As we examined in Capital Exhaustion and Longevity Risk example earlier, withdrawals have a negative impact on the value of your portfolio. This negative effect is magnified during down markets when you are selling securities at a discount, and diminished in rising markets, when you are selling securities at a premium. On average, however, unless your investment return can be expected to offset much of this negative impact, a RRIF portfolio will generally always decline in value.

The experience of individual RRIF holders can vary dramatically, depending on what growth rate they are achieving with their portfolio. As we examined in Portfolio E vs. F, highly conservative and secure portfolios are dangerously exposed to inflation, longevity and capital exhaustion risks. For these reasons and more, it is vital to review your plan with a qualified financial advisor and ensure that short-term volatility risks are balanced adequately against long-term capital exhaustion risk.