ivari: Annuity

Annuities from ivari

A ivari annuity provides regular, fixed income payments for the rest of your life. If you are looking for a guaranteed monthly income stream that will continue until your death, then a life annuity is the perfect retirement option.

Talk to an ivari Agent/Broker

The best way to learn more about annuities from ivari is to contact a ivari insurance agent or broker who speciallizes in annuity sales. An annuity broker deals with more than one company and can help you compare monthly incomes from all the different life insurance companies that sell annuities in Canada.

How to buy an annuity from ivari

- Start by completing an ivari annuity quote.

- Receive your ivari Annuity Illustration by email.

- Complete the ivari Annuity Application.

- Complete the transfer form(s).

- The following items are sent to ivari:

- ivari Annuity Application

- ivari Annuity Illustration

- Transfer Form (for registered funds) or

- Cheque payable to ivari (for non-registered funds)

- Void cheque for the payment of the monthly income

- Copy of a government issued photo ID

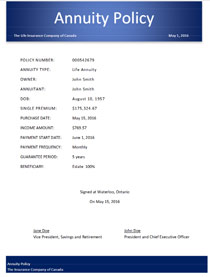

- Your ivari Annuity Policy is issued and mailed.

Completing an ivari annuity quote below is the first step in calculating your monthly income based on your personal needs.

Click here to get an ivari Annuity Quote

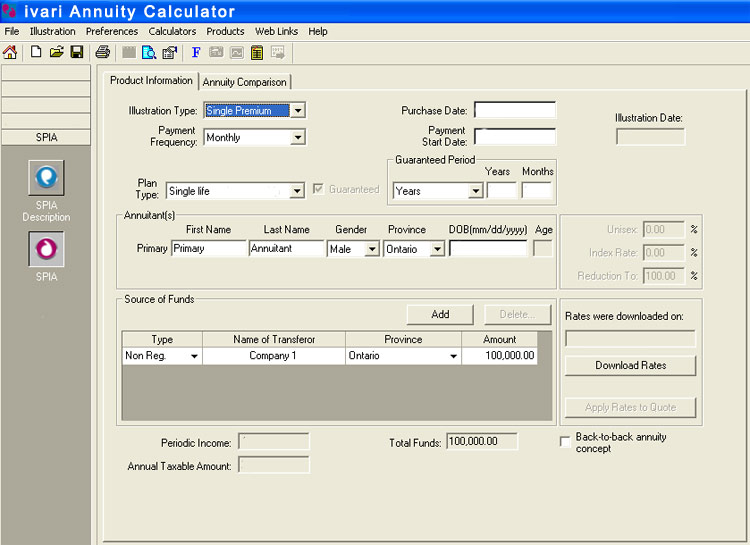

Once you submit your information, we'll calculate your annuity payout and send you the ivari Annuity Illustration the same day. Here is an example of a ivari Annuity Illustration.

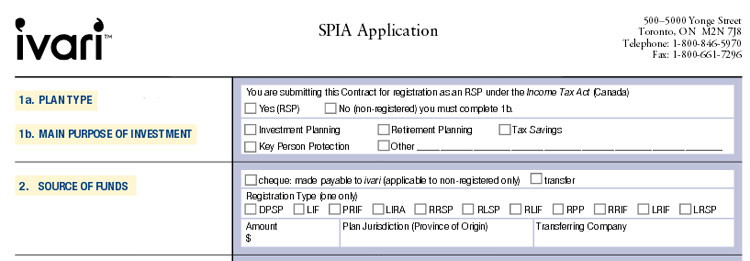

After reviewing the annuity illustration, the annuity broker will take down your information and complete the annuity application for you. Here is an example of a ivari Annuity Application.

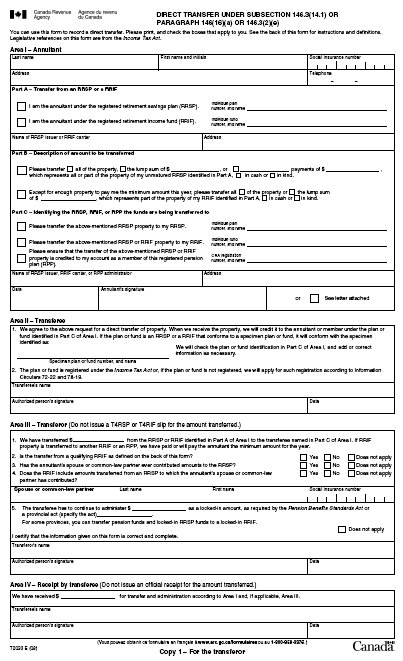

The annuity broker will complete the transfer forms that are necessary. Registered funds like your RRSP, RRIF or RPP are transfered from one institution to another using a transfer form. If the funds are coming from a non-registered source the annuity broker will ask you for a cheque that is payable to ivari.

Your annuity policy will be issued when the registered funds are transferred. Or when the non-registered funds have been cashed.

To Begin, Request An ivari Annuity Quote

About ivari

ivari is one of Canada’s leading individual life insurance providers, with $10 billion ($9.8 billion for ivari stand-alone and $0.2 billion for Canadian Premier Life (CPL) stand-alone) in total assets under management and total consolidated gross premium revenue of $1,036 million (781 million for ivari stand-alone + $255 million for CPL stand-alone) in 2016.

With headquarters in Toronto, ivari and Canadian Premier Life have offices in Vancouver, Burnaby, Calgary, London and Montreal, employing more than 740 people with a wide range of skills and expertise.

ivari first full year was owned by Wilton Re, a life reinsurance company. The transition from Transamerica and Aegon was largely completed, so that ivari has a Canadian business infrastructure

(Reference: www.ivari.ca)