Canada Life: Annuity Calculator

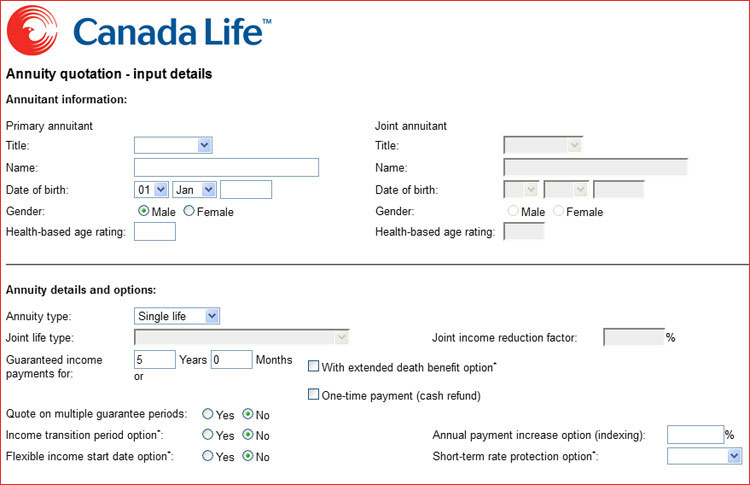

The following is a screenshot of Canada Life's annuity calculator used to obtain up-to-date annuity illustrations. Each annuity calculation is tailored to your unique needs and financial goals.

Calculate Your Annuity Payment

Calculate your monthly annuity payment using Canada Life's Annuity Calculator below.

Once you submit your information, we'll calculate your monthly annuity income and send you the Canada Life Annuity Illustration by email.

Canada Life's Annuity Calculator

About Canada Life Assurance Company

Founded in 1847, The Canada Life Assurance Company was Canada’s first domestic life insurance company. Today, Canada Life provides insurance and wealth management products and services in Canada and internationally.

Canada Life offers a wide range of insurance and wealth management products and services for individuals, families and business owners from coast to coast. Canada Life’s savings and investments, retirement income, life, disability and critical illness insurance products are available from independent brokers who are licensed representatives of Canada Life.

(Reference: www.canadalife.com)

Details on a Canada Life Annuity

A life annuity from Canada Life Insurance is an investment contract with a life insurance or investment company. To buy a contract, you need to make a lump-sum deposit with your annuity company. In exchange, the annuity company agrees to give you a monthly payment for the rest of your life. This is a great way to turn your retirement income into guaranteed, lifetime income.

If you are married, you can also use your life annuity to create guaranteed income for your spouse. This is called a joint-life annuity. As long as you or your spouse is alive, your Canada Life joint life annuity will continue to make payments. In exchange for this extra guarantee, a joint life annuity has a smaller monthly payment than a single life annuity.

A life annuity stops payments immediately after its owners die. If you die young, you may receive less in payments than you invested in the contract. If you don’t like the thought of this, you can design your life annuity with a guarantee period. If you die during the guarantee period, payments continue to your heirs for the length of the guarantee. In exchange for taking this extra feature, your monthly payments are different.

Annuity Payment Size

Your monthly life annuity payments depend on a few factors. It depends on the size of your investment. A larger investment creates a higher monthly payout. It also depends on your life expectancy. If you are younger and healthier, your payment is lower because the company needs to stretch your annuity contract for a longer period. Lastly, your payment size depends on which company you invest with. Each annuity company in Canada uses a different formula to determine its payouts. Taking the time to research your options with our free annuity calculators lets you find the best rate possible.