Why Buy An Index Annuity?

Ensure that your income keeps pace with inflation

The Inflation Problem

Inflation is a serious problem for retirees who are living on a fixed income. Inflation is a general increase in prices and a decrease in the purchasing power of money over time. When inflation is high, the value of money decreases and Canadian's savings and investments may not keep up with the rising cost of goods and services. As a result, it becomes harder for you to maintain your lifestyle.

Fortunately, insurance companies design annuity products that insure against inflation costs with an indexed annuity. An indexed annuity is a type of annuity contract where the payout is increased every year by a specific percentage which is determined at the time of purchase. By investing in an indexed annuity, you’ll ensure that your income keeps pace with inflation and you won’t have to force cuts to your budget.

Annuity Basics

When you purchase an annuity, you make a large initial deposit with an annuity company. In exchange for your purchase, the annuity company agrees to give you monthly payments for a certain period of time. Many retirees invest in life annuities because they provide guaranteed payments for the rest of their lives.

If you invest in a standard annuity, your monthly payment stays the same for the rest of your life. While the monthly income from a standard annuity may be enough at the start of your retirement, inflation will chip away at your buying power every year. Over time, inflation will have a large impact on your annuity payment, especially if your retirement is lasting 30 years or more. If you aren't prepared for a similar price increase during your retirement, you could run into serious problems in the future.

Index Annuity

Index annuities are designed to protect against inflation. As a result, they are sometimes called inflation protected annuities. When you buy an indexed annuity, the annuity company agrees to increase your monthly payment each year by a certain percentage typically anywhere between 0% to 6%. After a year of high inflation, your payments will get a measurable increase. Each year, your annuity payments will increase by the percentage set out in your contract.

The index protection feature does come at a cost though. Since you are making the same initial deposit as a standard annuity, the payout framework must be the same. To make this feature work, an index annuity makes smaller payments at the beginning. As each year passes, the indexed feauture on your annuity causes your payments to increase and eventually the indexed annuity will start paying out more per month than the standard annuity.

Unfortunately, as of 2023 you cannot purchase an annuity that is linked to CPI (Consumer Price Index) in Canada. You can only have your annuity payments increased by a certain percentage every year. You would have to have a copycat annuity to be able to have your payments linked to CPI.

Indexed Annuity vs. Standard Annuity

Non-Indexed Annuity

Single Life Annuity, Male, Age 65, 10 Year Guarantee, $100,000 Deposit, No Indexing<< /p>

Monthly Payout - $583.69 - View Illustration

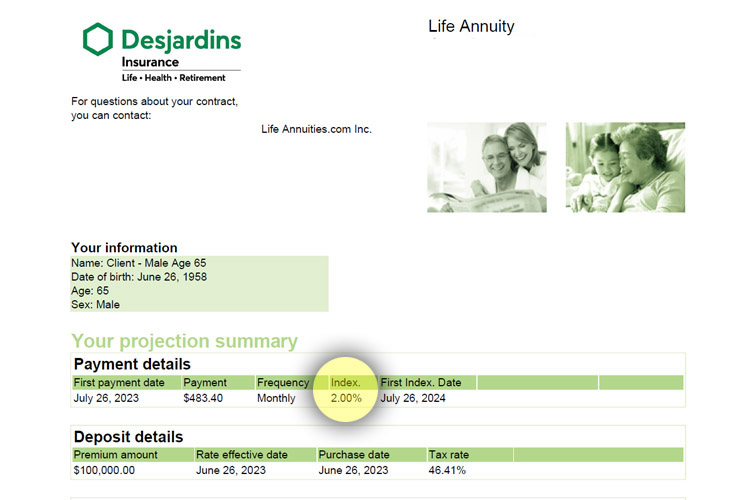

2% Indexed Annuity

Single Life Annuity, Male, Age 65, 10 Year Guarantee, $100,000 Deposit, 2% Indexing

Monthly Payout - $483.40 - View Illustration

Summary of Comparison

Standard Annuity: $583.69 Monthly Income

Indexed Annuity: $483.40 Monthly Income

You can see from these figures how long it would take before the indexed annuity payments match the payout of a standard annuity.

Suitability

Whether an index annuity makes sense depends on your plans for retirement. If you think your lifestyle and budget will stay about the same during the rest of your life, this is a great tool. It automatically budgets your savings and makes sure you have the same inflation-adjusted income for your entire retirement.

"If you want to spend more at the start of your retirement, an index annuity is not a good idea. You’ll have too little money when you want to spend more and too much money when you no longer need it. If you want more money during your early retirement, a standard annuity is better."

Risk of Inflation

Managing the risk of inflation can be a significant challenge. By investing in an indexed annuity, you move this risk to your annuity company. If you don’t mind lower initial payments and want to avoid the stress of rising prices, an indexed annuity may be the better option for you.