What is an annuity?

Introduction: What is an annuity?

An annuity is a guaranteed stream of payments that will provide you with a regular income for your lifetime. You, nor your spouse if included, can outlive the income. You can also have a guarantee for any number of years up to your age 90 for registered funds and longer for non-registered funds. An annuity provides a good income along with peace of mind. You don't want to worry about stock market fluctuations; what you want is steady income.

In addition, annuity payments aren't affected by market volatilty or fluctions in interest rates. They can offer protection against inflation through indexing, which provide yearly paymnet increases. They're also a potential source of tax-efficient income because only a portion of an annuity payment is taxable.

Best of all an annuity is simple. It's a one time purchase with no on going investment decisions to be made. An annuity is perfect for investors who are not interested in maging investmnets as they age.

Who is suited for an annuity?

- People nearing retirement

- Anyone concerned about outliving their retirement savings

- Early retirees who want more income until OAS begins

- Clients who must convert RRSP funds to an income stream

- Retirees with limited financial management experience

- People desiring an income stream to cover specific fixed expenses

- Anyone advising/managing finances for elderly parents

Why buy an annuity?

- People are living longer

- People are not prepared

Half of men reaching 65 can expect to live to age 85 or longer, and half of women reaching that age can expect to live until 88 or longer. So, retirement often spans 20 years or more for men and 23 years or more for women.

Many people aren't adequately prepared financilly for longer lives.

Longevity in Canada continues to increase. Yet, 69% of those already saving and 92% of those not yet saving beliove they will not have enough money to live comfortably throughout retirement.

Annuity Types

Lets take a look at the types of annuites that are available in Canada.

- Single Life Annuities

- Joint Life Annuities

- Term Certain Annuities

Provides a series of income paymnets for your life. You cannot outlive your payments.

Provides a series of income payments for as long as you or your spouse live.

Provides a series of guaranteed income payments for a chosen period (e.g. 5, 10, 15, 20 years).

Registered and Non Registered Annuities

The funds to purchase an annuity can be from a registered plan or a non-registered plan.

Registered Funds

You can convert the following list of registered funds into an annuity policy.

- RRSP - registered retirement savings plan

- RRIF - registered retirement income fund

- RPP - registered pension plan

- Locked-in RRSP / LIRA / RLSP

- LIF / LIRA / RLIF / PRIF

- DPSP - deferred profit sharing plan

Non-Registered Funds

You can convert the following list of non-registered funds into an annuity policy.

- Savings/Chequing Account

- GIC - guaranteed income certificate

- TFSA - tax free savings account

- Stocks

- Mutual Funds

Factors that affect annuity income

The amount of income provided through an annuity is determined by the:

- Type of annuity selected.

- Amount of money invested

- Age

- Sex

- Payment guarantee selected

Advantages of an annuity

- Provide a regular income stream for retirement

- Payments will continue, unchanged, for life or the designated term regardless of interest rate fluctuations

- As part of a diversified retirement income plan, annuities reduce risk, add stability

- Ideal to top-up retirement income

- Annuities can create personal pension plans for those without pension plans

- Annuities can be integral to estate planning (i.e. death benefit guarantees, appointment of beneficiary to avoid probate, if any and create potential creditor protection1, etc.)

- Suitable for investors who can’t or don’t want to actively manage part of or all of their capital

- No one knows how long they will live, and with a life annuity, your clients can never outlive their money. Joint life annuities can also protect their spouse’s income

Disadvantages of an annuity

- The loss of investment value due to an early death

- The income amount is fixed

- Purchasing power reduces with inflation – if an indexed annuity is not selected

- Your ability to draw lump sums from your fund is gone

Why an Annuity?

- Steady, reliable, guaranteed income

- Reduces worry of outliving your retirement capital, delaying your retirement, and downsizing your lifestyle

- Provides a higher income than other alternatives of similar security

Annuity popularity

- Our aging population, baby boomers are heading into their retirement years.

- People are retiring earlier and living longer. This creates growing demand for products such as annuities to ensure retirement income lasts a lifetime.

- More people are proactively financing retirement because government sources like old age security (OAS), and Canada pension plan (CPP) and Quebec pension plan (QPP) may not provide adequate income.

- Annuities often complete a balanced, effective retirement income plan.

- Annuity products are now more innovative, with numerous options for convenient customization.

- People are more risk averse and wary of market volatility, shifting some of their investments to more secure sources of income.

Annuity Options

Choose from the following options and features to enhance your annuity to suit your needs.

- Guaranteed Period

- Indexing

- Deferred

- Impaired

With a life annuity you, nor your spouse if included, can outlive the income.

You may choose to purchase a guarantee period for any number of years up to your age 90 for registered funds and longer for non-registered funds.

Payments can be guaranteed for a specific term. When included in a life or joint life annuity, upon your death/co-annuitant’s death, this may provide guaranteed payments to your beneficiary, which will continue until the term expires. For example, depending on the plan you choose from 5 to 20 years of guaranteed payments. In the event of death and if the guarantee period has not expired, your payments can be made to a named benefificary or taken as a lump sum.

To help offset inflation, you may choose to have income payments increase at a fixed annual rate, to a maximum of four per cent for registered annuities and six per cent for non-registered annuities.

If you don’t want to start receiving payments immediately, you can defer them to a later date. With the guaranteed income option on a deferred annuity, you may be able to add a return of premium option; this allows for return of premium if the annuitant dies before payments begin.

Impaired annuities are for people with health problems severe enough to affect their life expectancy. Income payments are higher than the standard life annuity and won’t decrease, even if medical advances improve the annuitant’s life expectancy.

Turning 71

Your Registered Retirement Savings Plans (RRSPs) must be converted to one or more of the following retirement income options by the end of the calendar year in which you turn 71

- An Annuity

- A Registered Retirement Income Fund (RRIF)

- A lump-sum cash withdrawal

RRIFs

How they work: like an extension of your RRSP. Your investments continue to grow tax-free but you must stop contributions and withdraw a certain amount of income from your RRIF each year.

RRIF Advantages

- you retain personal control over your investments

- flexibility to change your income and make lump sum withdrawals

RRIF Disadvanatages

- you could outlive your RRIF income

- requires ongoing management

RRIF or Annuity?

What should you choose to provide your retirement income, an immediate Annuity or a RRIF? There is no simple answer - it depends on your risk tolerance, investment knowledge and personal circumstances. Risks that should be considered include: the risk that equity markets will decline or underperform, the risk that interest rates will change and the risk that inflation will be higher than expected. To mitigate these risks a combination of Immediate Annuity/RRIF may be used.

Taxation of Annuities

- If funds were registered (eg. RRSPs) – Income is 100% taxable

- If funds were non-registered – Only the interest portion of income payments is taxable

Assuris Protection

If your life insurance company fails, your Payout Annuity policy will be transferred to a solvent company.

On transfer, Assuris guarantees that you will retain up to $5,000 per month or 90% of the promised Monthly Income benefit, whichever is higher.

Annuity Pros & Cons

Pros

- Life Annuities pay more than GICs for the same dollar

- Cannot outlive income

- No investment or management decisions

- Can spend every penny without worry

- Assuris insurance coverage up to $5,000 per month

- Prescribed Annuities are tax efficient

Cons

- After you commit to the terms of an annuity, you cannot change them.

- Income payments cannot be adjusted to reflect changing needs

- Permanently replaces investment capital

- Decision once made is final, can’t convert an annuity into another form of retirement income

Annuity Fees

There is typically no fees involved when purchasing an annuity policy. An insurance broker or agent is payed by the insurance company that sells you the annuity.

List of Annuity Companies

Only Canadian insurance companies in Canada can sell annuities but not all companies sell annuities. The list below is a list of insurance companies that sell annuities in Canada.

Standard Life Insurance (now Manulife)

Transamerica Life Insurance (now ivari)

Male Annuity Rates

Annuity rates shown below are registered. Monthly incomes based on a premium of $100,000. Payments will commence in one month. Annuity rates as of November 25, 2024.

| Annuities: Single life male, no guarantee | ||||||

|---|---|---|---|---|---|---|

| Company | Age 55 | Age 60 | Age 65 | Age 70 | Age 75 | Age 80 |

| BMO Insurance | 484.21 | 527.26 | 581.55 | 657.54 | 757.95 | 931.34 |

| Canada Life | 461.26 | 498.88 | 552.35 | 632.50 | 755.19 | 950.02 |

| Desjardins | 477.14 | 517.17 | 572.58 | 652.28 | 760.67 | 904.92 |

| Empire Life | 445.04 | 487.12 | 544.71 | 623.17 | 727.57 | - |

| Manulife | 487.83 | 530.11 | 585.10 | 660.95 | 763.83 | 951.47 |

| RBC Insurance | 455.98 | 494.08 | 546.53 | 624.17 | 743.97 | 935.77 |

| Sun Life | 461.67 | 498.84 | 552.06 | 633.93 | 759.93 | 950.60 |

Female Annuity Rates

Annuity rates shown below are registered. Monthly incomes based on a premium of $100,000. Payments will commence in one month. Annuity rates as of November 25, 2024.

| Annuities: Single life female, no guarantee | ||||||

|---|---|---|---|---|---|---|

| Company | Age 55 | Age 60 | Age 65 | Age 70 | Age 75 | Age 80 |

| BMO Insurance | 465.30 | 497.66 | 543.27 | 605.50 | 663.79 | 814.21 |

| Canada Life | 437.57 | 467.88 | 510.28 | 570.24 | 657.92 | 793.49 |

| Desjardins | 454.14 | 488.67 | 535.83 | 601.92 | 689.51 | 817.44 |

| Empire Life | 421.22 | 454.99 | 501.56 | 567.48 | 663.51 | - |

| Manulife | 468.33 | 500.57 | 546.46 | 609.19 | 690.18 | 832.81 |

| RBC Insurance | 435.92 | 470.20 | 516.22 | 580.49 | 677.32 | 832.52 |

| Sun Life | 439.58 | 474.57 | 521.16 | 588.97 | 686.68 | 848.86 |

Joint Annuity Rates

Annuity rates shown below are registered. Monthly incomes based on a premium of $100,000. Payments will commence in one month. Annuity rates as of November 25, 2024.

| Annuities: Joint life, no guarantee | ||||||

|---|---|---|---|---|---|---|

| Company | 55 | 60 | 65 | 70 | 75 | 80 |

| BMO Insurance | 431.43 | 453.58 | 485.43 | 528.64 | 559.59 | 663.44 |

| Canada Life | 411.87 | 434.56 | 467.07 | 514.46 | 585.21 | 694.51 |

| Desjardins | 425.00 | 451.50 | 488.40 | 541.04 | 610.33 | 723.24 |

| Empire Life | 394.80 | 420.25 | 455.33 | 504.65 | 576.01 | - |

| Manulife | 431.89 | 455.45 | 491.71 | 542.23 | 614.52 | 714.20 |

| RBC Insurance | 411.25 | 436.49 | 471.10 | 519.64 | 591.73 | 706.67 |

| Sun Life | 413.00 | 434.87 | 466.60 | 518.34 | 591.62 | 702.98 |

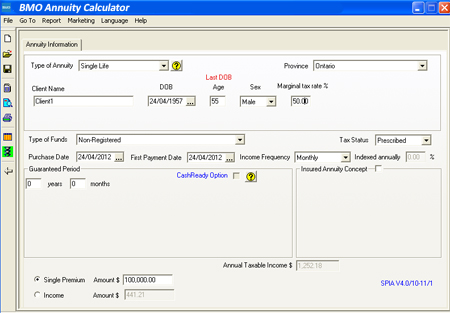

Annuity Calculator

Each insurance company has there own indvidual annuity illustration software that calculates the annuity quote. Below is an example of an annuity calculator from BMO Insurance.

Sample of an Annuity Policy

This document explains in detail all the terms and features of your annuity contract. While an annuity policy may seem intimidating at first, it’s really not that complicated to understand. This guide explains the different sections of a sample annuity policy so that you will be able to understand your own contract.

Click the link or image to view a Sample of an Annuity Policy

Annuity Quote Illustration

Annuity quote or annuity illustration.Click on the link or image to view a sample of an annuity quote.

Conclusion

For those of you that think Social Security will meet your retirement needs, wake up! Given the massive debt overhanging the U.S. economy, the current generous benefits being paid out to retirees is not sustainable

Annuities Are an Important Part of Retirement Planningretirees should convert at least half of their retirement savings into a lifetime income annuityn annuity pays out for as long as you live retirees should consider buying income annuities to cover some basic expenses for the rest of their lives.

GAO Report: Buy More Annuities!

The United States Government Accountability Office recently released report on retirement income.

The GAO began by stating the obvious: “The risk that retirees will outlive their assets is a growing challenge.” For consumers facing fewer and at-risk traditional pension plans, increased life expectancies, highly volatile financial markets and substantial losses to home equity over the recent past, “growing challenge” seems like a major understatement. Indeed, a husband and wife who are both 65 years old have roughly a 47 percent chance that at least one of them will live until 90 and, according to data from the Employee Benefit Research Institute, roughly half of near-retirees today are likely to run out of money and not be able to cover their basic expenses and uninsured health-care costs later in life.