Best GIC Rates: Canada 2021

GIC Rates

Best GIC Rates: Canada 2021

Investors are understandably attracted to guaranteed investment certificates (GIC). They are a safe choice, because the principal investment and the interest rate are guaranteed by the bank, credit union, or online financial institution that sells them to investors. This can add stability to a portfolio in uncertain times and virtually eliminates the risk of loss due to CDIC insurance, even if the financial institution fails.

The Canada Deposit Insurance Corporation (CDIC), a crown corporation, provides this second layer of protection. Should the financial institution fail, the CDIC provides coverage of the principal and interest of up to $100,000 on GICs. As a result, GICs are considered one of the safest investments available on the market.

Guaranteed investment certificates are often favoured for short-term savings. However, some investors also use a more complex GIC laddering system. Laddering involves dividing the total investment amount into smaller GICs with each term staggered by a year. As each GIC matures, the investor can either find the best GIC rates and reinvest or access the money.

Best 1 & 2 Year GIC Rates

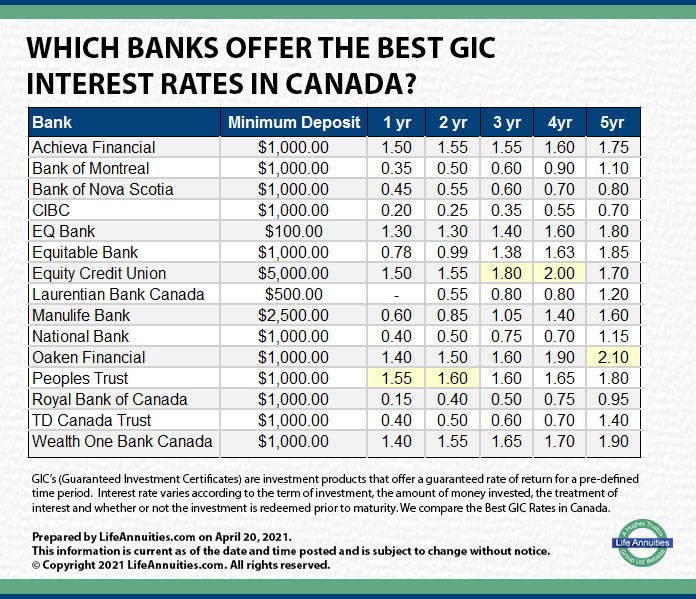

April 20, 2021 - For today's Best GIC Rates click here.| Institution | 1-year | 2-year | 3-year | 4-year | 5-year |

|---|---|---|---|---|---|

| Peoples Trust | 1.55% | 1.60% | 1.60% | 1.65% | 1.80% |

Peoples Trust Company is a Canadian financial services company based in Vancouver, served Canadians since 1985. Their GICs are eligible for CDIC coverage.

Best 3 & 4 Year GIC Rates

April 20, 2021 - For today's Best GIC Rates click here.| Institution | 1-year | 2-year | 3-year | 4-year | 5-year |

|---|---|---|---|---|---|

| Equity Credit Union | 1.50% | 1.55% | 1.80% | 2.00% | 1.70% |

Equity Credit Union has been serving its members faithfully since 1942. All deposits in RRSPs, RRIFs, RDSPs, RESPs and TFSAs are 100% insured by the Financial Services Regulatory Authority of Ontario.

Best 5 Year GIC Rate

April 20, 2021 - For today's Best GIC Rates click here.| Institution | 1-year | 2-year | 3-year | 4-year | 5-year |

|---|---|---|---|---|---|

| Oaken Financial | 1.40% | 1.50% | 1.60% | 1.90% | 2.10% |

Oaken Financial is backed by Home Bank, and powered by Home Trust Company, Canada’s largest independent trust company that has served Canadians since 1987. Their GICs are eligible for CDIC coverage and they can be held in registered or non-unregistered plans.

They offer a competitor rate comparison page and a GIC calculator. They are an on-line only bank.

Shifting GIC Landscape

Once, guaranteed investment certificates were relatively straightforward. The individual decided how much they wanted to invest and for how long. Then it was just a matter of finding the best GIC rates. However, today’s GIC landscape differs greatly.

Financial institutions are constantly coming up with new GIC offerings, each with their own advantages and disadvantages. Some guaranteed investment certificates also have tax implications when held within registered accounts such as a RRSP, TFSA or RRIF.

The variety of terms and GIC types is extensive. Before an investor can even consider finding the best GIC rates, they need to understand the range of products. Otherwise, they could think they’re getting a great rate when they’re really comparing apples and oranges.

GIC Types

Even though a guaranteed investment certificate is a good financial vehicle for savings, it is not like a savings account. Once the investor buys their GIC they’ve committed their money for a certain length of time.

Typically, a guaranteed investment certificate locks in funds throughout the term. Funds may not be accessible or accessible at a cost, depending on the product chosen.

Terms usually range between one and five years, but exceptions exist. GIC Interest rates vary between providers and also depend on term length. Normally, the longer the term, the higher the interest rate.

Fixed-Rate

The most common GICs available have fixed interest rates. The interest remains the same throughout the term and interest is awarded at the end of the term when the GIC reaches maturity.

Variable-Rate / Adjustable-Rate

Variable-rate or adjustable-rate guaranteed investment certificates are linked to a bank’s prime rate. The interest rate changes throughout the term and investors benefit if the prime rate goes up. However, investors also take on more risk as the prime rate can also fall and they may earn less interest.

Step-Rate

Step-rate guaranteed investment certificates guarantee an increased interest rate each year. Financial institutions promise competitive interest rates to encourage investments over longer periods.

Market-Linked

These are the latest product on the market and favoured by Canada’s big banks. They’re a hybrid of a traditional guaranteed investment certificate and investments linked to the stock market.

Market-linked GICs still have insurance eligibility, but their performance is dependent on a specific stock market index such as the S&P 500. Potentially, this could offer higher returns without risking the original investment.

However, it is also possible that the GIC may not produce a return if the stock market index does poorly. Some companies offer small minimum returns so investors receive slightly more than their original investment if this occurs.

Market-linked GICs may also include limitations on maximum returns. For instance, if the stock market index increases 40% and the GIC has a 30% limitation, the investor would only enjoy 30% of the total return.

Some market-linked GICs also stipulate a participation rate which limits returns. If the GIC has an 80% participation rate, the investor only receives an 80% return, instead of 100%.

Registered

Registered guaranteed investment certificates can be held in government-recognized accounts such as a RRSP, RRIF, TFSA, RESP or RDSP. Since these accounts are tax-exempt until withdrawal, interest earned remains tax-free.

However, government registered accounts also include many rules and regulations including contribution limits, taxation on withdrawals, and penalties for over-contributions.

Non-Registered

Non-registered guaranteed investment certificates include all other GICs not held in registered government accounts. They are potentially taxable, but are also less restricted by rules and regulations potentially making it easier for an investor to withdraw funds.

Foreign Exchange

Guaranteed investment certificates are also available in non-Canadian currencies. The most popular is a U.S. dollar GIC. Investors basically speculate on an increase in the foreign currency against the loonie. A foreign exchange GIC can add diversity to a portfolio and it qualifies for CDIC insurance.

GIC Variations

To make matters even more complicated, all these GIC types are usually available in three variations: non-redeemable, redeemable, or cashable.

As mentioned almost all guaranteed investment certificates are non-redeemable. In other words, once funds are invested in the GIC they are locked in until maturity. However, financial institutions also offer redeemable and cashable options for investors if they want more liquidity. Nonetheless, this luxury comes at a cost.

Funds in a cashable GIC are available after a fairly long waiting period, without penalty. Redeemable GICs do not have a waiting period, but may include early redemption rates that typically result in a much lower interest rate.

Choosing the Right GIC

A guaranteed investment certificate isn’t a long-term investment solution. It is best-suited for the preservation of capital within a known, short timeframe. However, it can fit into an investor’s portfolio as a way to protect funds for the short-term.

Clearly, investors have many GIC options and not every GIC suits every investor. While a GIC is a safe investment, it usually can’t rival the returns many other investment products offer.

In actuality, most GICs won’t stay ahead of or barely stay ahead of inflation, projected at 1.6% for 2021. Even the best GIC rates can’t offset inflation unless an investor chooses more than a three-year term. However, they can earn slightly more than in a high-interest savings account.

Generally, the best GIC rates on these financial products have five-year terms. Nonetheless, choosing the best GIC rates doesn’t make sense unless the product type and term match the investor’s personal time horizon and investment expectations. Even then, finding the best GIC rates isn’t as simple as it should be.

Finding the Best GIC Rates

Shopping around for guaranteed investment certificates can be a daunting task. With so many products available one might think it is just a matter of surfing the internet to find a product that meets needs with a good interest rate. Unfortunately, that’s not necessarily the case. Besides being very time-consuming, search results may not deliver complete comparison results.

Investors may diligently fill out online GIC forms regarding investment amount, term, location, and product type to receive their computer-generated results. Regrettably, these results are often sponsored and aren’t always the best GIC rates available on the market. They’re just the one the particular website wants you to buy.

Just visit a few websites and you will notice that each list of companies with the best GIC rates varies greatly, depending on who’s promoting what. The big banks sell their own products, but brokers will mention the Royal Bank, TD Bank, Scotiabank, Bank of Montreal, or Bank of Commerce, only if they’re receiving an affiliate commission.

There’s a reason the big banks rarely offer the best GIC rates. Admittedly, they sometimes offer what sound like enticing GIC specials. However, when you compare their interest rates to those of online financial companies, they just don’t compare. Online companies don’t pay the hefty overhead of brick-and-mortar financial institutions. Consequently, they can offer investors much better interest rates.

The only reason an investor might choose to buy a guaranteed investment certificate through a big bank is that they already know them and trust them. Nevertheless, they shouldn’t expect the best GIC rates if they choose to buy through their bank.

Unbiased Online Comparisons

Independent, unaffiliated GIC comparison websites are hard to find. LifeAnnuities.com offers an educational website with a table that compares GICs from financial institutions, banks, and credit unions. It is updated daily and summarizes one-to-five-year non-redeemable, non-registered GICs.

We will review the top three companies listed on this website with the best GIC rates. However, it is important to remember that these ratings are for one specific GIC type from one information source. Since interest rates fluctuate, it is important to visit the financial institution’s website to find current information and new products pop up regularly.

Many others avenues exist for investors to discover the best GIC rates. If you want to explore other products and need to know if GICs suit your portfolio, you will need unbiased advice and expertise. We discuss this later.

Independent Broker

Your investments should suit your risk tolerance level, investment time horizon, and return expectations. An independent broker can provide you with investment expertise, unbiased advice, and access to current information on the best GIC rates.

As mentioned, guaranteed investment certificates can play a role in an investor’s portfolio. However, they are not a long-term solution. They offer a conservative investment approach for a short time horizon.

GICs can also help an investor if they’re working towards a specific goal such as saving for a down payment on a home or putting aside money for a high school student who will enter college or university soon.

A guaranteed investment certificate may also help investors that tend to dip into their high interest savings account. A locked in GIC can discourage an investor from withdrawing funds.

GICs may also be a good choice for those with a very low risk tolerance level. Investors needn’t worry about stock market fluctuations or buying bonds to reduce interest rate and credit risk.

However, investors should explore all options since other financial products can offer the same level of security, but with better returns. GICs may not make sense for young investors with longer time horizons due to these minimal returns.

An independent broker can help you build, monitor, and administer your investment portfolio. They will tailor your asset mix to suit your risk tolerance level. For instance, a conservative portfolio might include guaranteed investment certificates, some equities such as stocks, and a small percentage of cash or cash equivalents. A more aggressive portfolio would likely focus more on equities, with fewer GICs.

If all this seems overwhelming, it needn’t be. Life annuities can connect you a skilled independent broker who knows guaranteed investment certificates. We believe financial advice shouldn’t be limited to investments. We offer expert advice and access to a broad range of wealth management services too such as retirement and estate planning, insurance, and more.

Contact us for a free consultation and tap into the best GIC rates available on the market easily. Our independent brokers represent many companies and have a fiduciary duty to protect your interests. You may discover GICs you weren’t aware of or other financial products that better suit your needs.

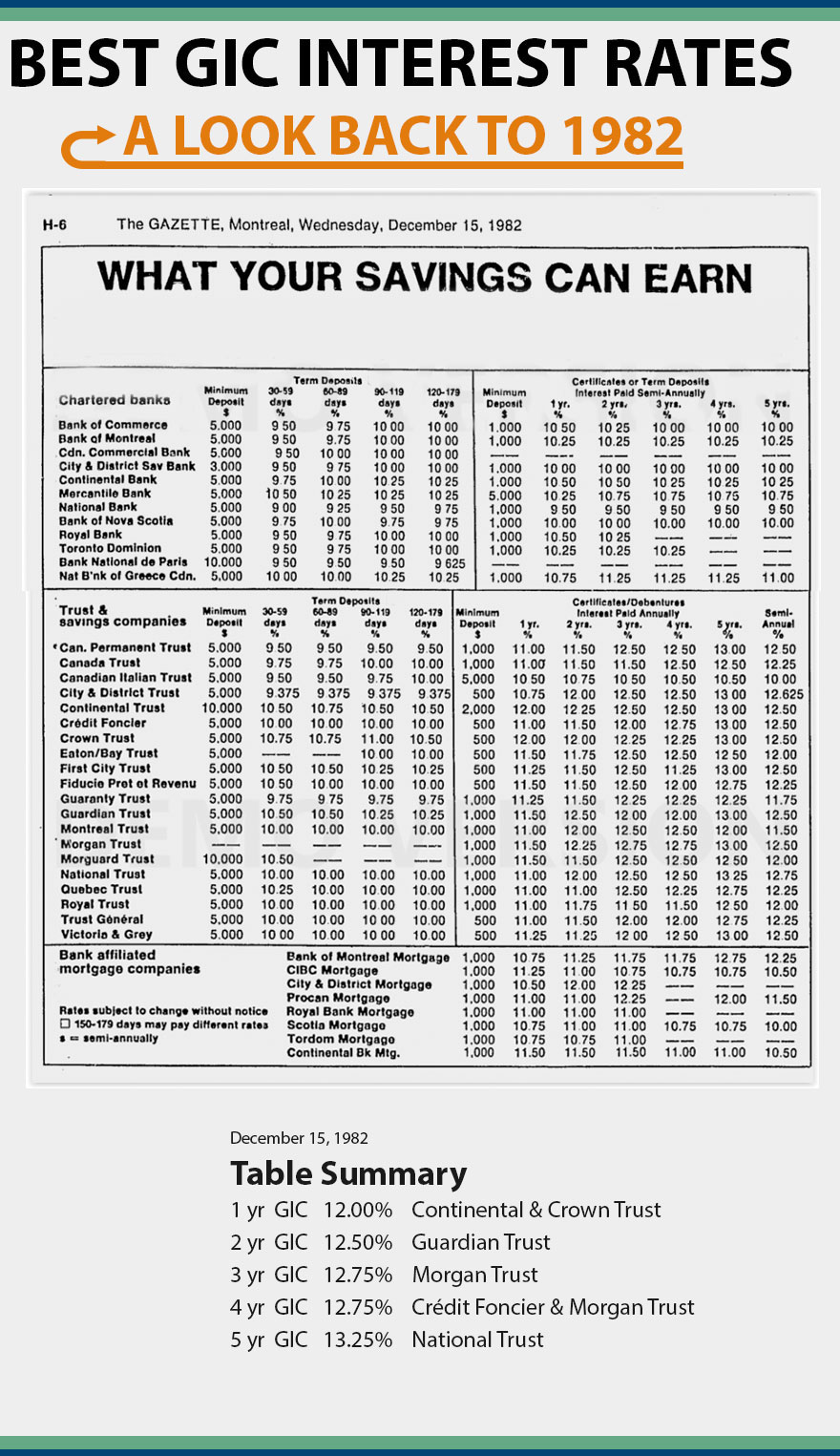

A Look Back In History

Looking back in time, the 1980s had the best GIC interest rates. This GIC comparison chart from December 15, 1982 which had 5 year interest rates at 13.25% (source: The Montreal Gazette).

What to do now?

- We supply you with the best investments in Canada as our brokers represent all the best financial institutions in Canada. For personal assistance on your GIC please use our GIC Form.