2012 Annuity Rates

Best Annuity Rates in Canada

2012 Annuity Rates

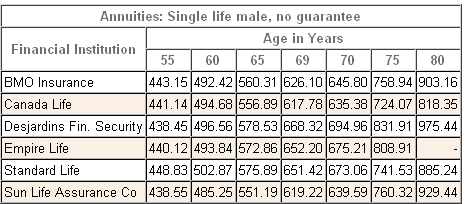

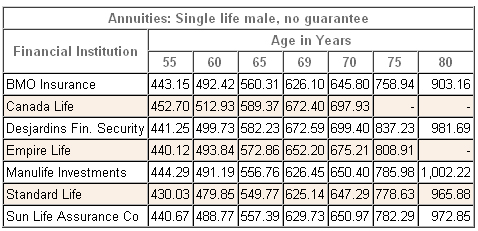

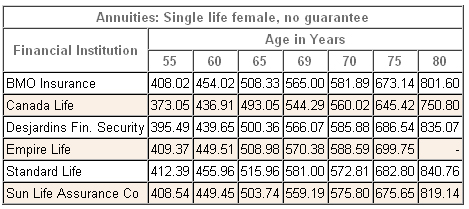

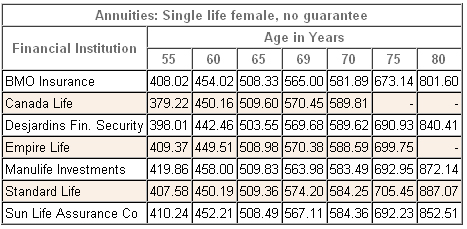

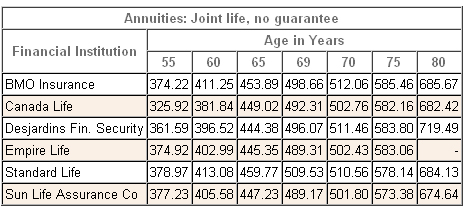

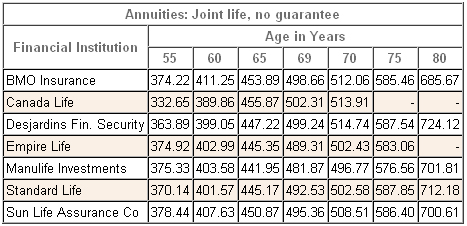

The Tables below show the monthly incomes for annuity rates based on a premium of $100,000. Income starts in 1 month.

Canadian Annuity rates as of April 2, 2012.

2012 Annuity Rates: Male | Non-registered

2012 Annuity Rates: Male | Registered

2012 Annuity Rates: Female | Non-Registered

2012 Annuity Rates: Female | Registered

2012 Annuity Rates: Joint | Non-Registered

2012 Annuity Rates: Joint | Registered

2011 Annuity Rates

To compare annuity rates, click the link to view annuity rates in 2011.

2012 Annuity Rates

To compare annuity rates, click the link to view annuity rates in 2012.

2013 Annuity Rates

To compare annuity rates, click the link to view annuity rates in 2013.

2014 Annuity Rates

To compare annuity rates, click the link to view annuity rates in 2014.

Canadian Annuity Rates

Annuity rates in Canada change constantly due to various factors, some of which are not apparent to the annuity buying public in Canada.

Let's first examine how annuity rates are arrived at and how the public in Canada can take advantage to secure the highest income.

When a person says "Who has the best annuity rates in Canada" he or she means, "which company is paying the most monthly income" for their registered or non-registered funds.

Each company has different needs for each age bracket which is the reason that while company X is paying the most at age 65, it may be 5th highest at age 70 and not competitive at age 72.

So annuity rates are not necessarily competitive at all ages, espcially when the age of a spouse is blended in with a joint life annuity.

Now at some particular time, the company will receive enough money for that certain age bracket and will drop its annuity rates so that it does not receive any more Applications.

And that is a major reason you must see all the annuity rates in Canada when making your decision if you want the highest income available.

Some other reasons annuity rates change frequently are financial forces such as Canadian bond rates which fluctuate with interest rates both in and outside Canada.. Another reason annuity rates change is due to the lack of demand for capital. If the money cannot be invested at a profit, a life insurance company will not raise its annuity rates to attract applications.

2012 Annuity Rate Providers in Canada

- BMO Insurance

- Canada Life Insurance

- Empire Life

- Great West Life

- Industrial Alliance

- La Capitale

- Manulife Investments

- Standard Life Insurance

- Sun Life Assurance Company

- Transamerica Life Canada

Get Your Own Exclusive Annuity Rate

Click our online annuity quote to get your annuity rate.

Enter the principal amount to invest and we'll provide the exact monthly income you will receive for the rest of your lifetime.