2011 Annuity Rates

Best Annuity Rates in Canada

2011 Annuity Tables

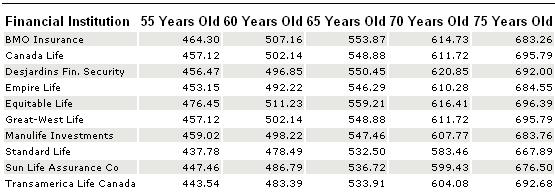

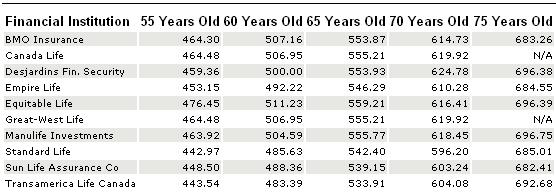

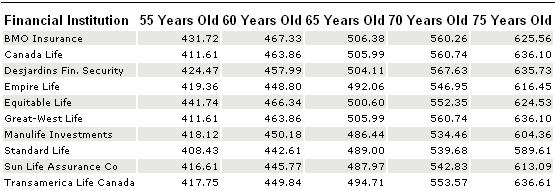

Annuity tables show the monthly incomes for a annuity rates based on a premium of $100,000. As of March 17, 2011.

Single Annuity Rates, Male, Non-registered

Single Annuity Rates, Male, Registered

Single Annuity Rates, Female, Non-registered

Single Annuity Rates, Female, Registered

Joint Annuity Rates, Non- registered

Joint Annuity Rates, Registered

2011 Annuity Rates

To compare annuity rates, click the link to view annuity rates in 2011.

2012 Annuity Rates

To compare annuity rates, click the link to view annuity rates in 2012.

2013 Annuity Rates

To compare annuity rates, click the link to view annuity rates in 2013.

2014 Annuity Rates

To compare annuity rates, click the link to view annuity rates in 2014.

What insurance companies provide annuity rates in 2011?

- Assumption Life

- BMO Insurance

- Desjardins Fin. Security

- Empire Life

- Equitable Life

- Great-West Life

- Industrial Alliance

- La Capitale

- Manulife

- Standard Life

- Sun Life Assurance Co

- Tranamerica Life of Canada

Obtain Your Own Annuity Rates

Complete our annuity rates form and get a complete list of annuity rates in Canada within 24 hours.

When will annuity rates in Canada go up?

Many, many times I am asked this question or I'm told "I'll wait until the life annuity rates go up". Go up where and how and why? Life annuity rates have nothing to do with GIC rates but this is what I frequently hear. There has been a low interest rate environment in Japan for 23 years and in the US and Canada for the last 8 years at least! How doyou know that it will change?

And all this assumes that life annuity rates in Canada are dependent on long term interest rates to the exclusion of other factors and this is not so. Your age and the age of your spouse, is a very important factor in the calculation.

Do not wait for annuity rates in Canada to increase

So while you sit there waiting for "the life annuity rates to increase", your remaining months are passing you by. If you can get $1000 today but wait and receive $1100 in 1 year what have you achieved? You have not received $12,000 for the year you decided to wait and will take 10 years to make up the income.

If you decide to wait, you need to win on 2 fronts. Firstly you need to be sure to live another 10 years. And you need to assume correctly that the annuity rates will increase. And of course you can't be sure of either. And here's another problem; what if the rates go down? Now what do you do?

And let me also mention that the European Court of Justice is about to rule that, on the grounds of equality, men should be paid the lower life annuity rate paid to women due to their longer life expectancy.

What if women were offered the same annuity rates as men?

If that comes to Canada and the US, waiting for "a better life annuity rate" will become a thing of the past.