Annuities vs GICs

Proof that Annuities are Better than GIC's

Annuities vs GICs: Proof that Annuities are Better than GIC's

The best GIC interest rates are under 3% for a five year term in 2014.

With GIC interest rates at record lows, it's tough to make your investments generate the income you need. To get the most from your money, you have to make the smartest investments you can as GIC interest is fully taxable.

But income from non-registered annuities is only partially taxable.

Current GIC Rates as of February 13, 2014

| GIC INTEREST RATES | |

|---|---|

| Company | 5 Year Term |

| Achieva Financial | 3.000 |

| B2B Bank | 2.500 |

| Bank West | 1.850 |

| Bank of Montreal | 1.950 |

| Bank of Nova Scotia | 1.750 |

| CIBC | 1.500 |

| Caisses Desjardins | 1.750 |

| Canada Life | 1.400 |

| Canadian Western Bank | 2.500 |

| Effort Trust | 2.600 |

| Empire Life | 2.200 |

| Great-West Life | 1.650 |

| HSBC Bank Canada | 1.950 |

| Home Trust Company | 2.550 |

| ICICI Bank Canada | 2.650 |

| ING Direct | 2.550 |

| Industrial Alliance | 1.950 |

| Laurentian Bank Canada | 1.750 |

| Laurentienne Trust | 1.750 |

| London Life | 1.650 |

| Manulife Bank | 2.450 |

| Manulife Investments | 2.250 |

| Manulife Trust | 2.450 |

| National Bank | 1.750 |

| Outlook Financial | 3.100 |

| Peoples Trust | 2.300 |

| President's Choice Fin'l | 2.500 |

| Royal Bank of Canada | 2.200 |

| Standard Life | 2.275 |

| Sun Life - Insurance | 2.300 |

| Sun Life - Trust | 2.650 |

| T-D Mortgage | 2.300 |

Compare annuity payments to GIC payments

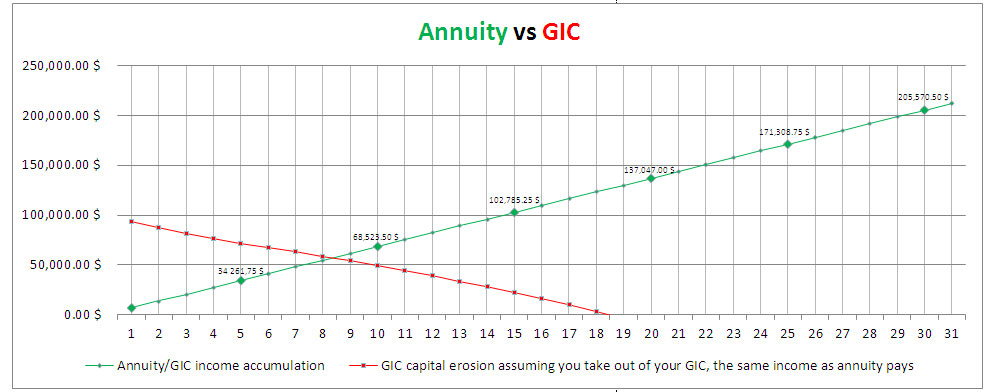

For conservative investors, GICs are a time-tested favorite for providing income. But many people have discovered that annuities offer better monthly income and are designed to provide that income for your lifetime.

So which investment is the smarter way to get the income you need?

GICs are among the safest investments available, as they're insured up to $100,000.

Alternatively, income from annuities is greater and insured up to $2000 a month by Assuris.(Update: As of May 25, 2024, Assuris you will retain up to $5,000/month or 90% of your promised monthly income benefit, whichever is higher.)

Why is an annuity better?

Annuities come with some other benefits as well. Unlike GICs, annuities generate lifetime income; you can never outlive it.

Which should you pick?

Whether a GIC or an annuity is smarter for you depends on your specific financial needs. The key in deciding is to understand that, despite looking similar, GICs and annuities are very different.

Make sure you know the difference between an annuity and a GIC. You should go over all the benefits of an annuity with a professional advisor and see if an annuity is best for you.

If you currently have a GIC, we would be happy to review it for you to ensure that it is providing you with the best benefits available today.