What is an annuity?

Guaranteed income payments that will last your lifetime.

What is an annuity?

An annuity is a guaranteed stream of payments that will provide you with a regular income for your lifetime. You, nor your spouse if included, can outlive the income. You can also have a guarantee for any number of years up to your age 90 for registered funds and longer for non-registered funds. An annuity provides a good income along with peace of mind. You don't want to worry about stock market fluctuations; what you want is steady income.

What are the key advantages of an annuity?

- Provide a regular income stream for retirement.

- Payments continue for the designated term, regardless of stock market or interest rates.

- As part of a diversified retirement plan, annuities reduce risk and add stability.

- Ideal to top-up retirement income.

- Annuities can create personal pension plans for those without company or government pension plans.

- Annuities are suitable for people who can’t or don’t want to actively manage some or all of their capital.

- With a life annuity, you will never outlive your money.

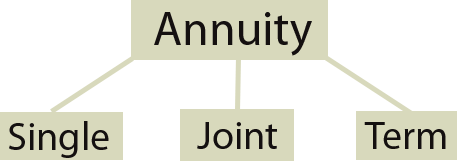

Types of Annuity Products sold in Canada

There are a variety of annuities you can customize to meet your specific needs. You can use your registered or non-registered assets to purchase an annuity.

What is a single annuity?

A single life annuity provides you with an income for as long as you live. Convenient and practical, a life annuity ensures you won’t outlive your money.

What is a joint annuity?

This annuity is payable while either you or your spouse are living. When one spouse dies, the survivor will continue to receive income payments as agreed upon when the annuity contract was established. The same income can continue to the surviving spouse, if the funds are not registered.

What is a term certain annuity?

This annuity provides you with a set number of payments until age 90 (if you base the annuity on a younger spouse the payments will be made until that spouse reaches age 90). For a nonregistered annuity, payments may be for any period.

What are some annuity options?

Choose from the following options to enhance your annuity to suit your financial needs.

1. Guaranteed term option

Payments can be guaranteed for a specific term (e.g. 5, 10, 15, 20 years). On its own, this is a term certain annuity. When included in a single life or joint annuity, upon your death/ co-annuitant’s death, this may provide guaranteed payments to your beneficiary, which will continue until the term expires.

2. Indexing option

To help offset inflation, you may choose to have income payments increase at a fixed annual rate, to a maximum of four per cent for registered annuities and six per cent for non-registered annuities.

3. Deferred annuity option

If you don’t want an immediate annuity, you can defer payments to a later date. You may also customize payment options with income commencing on pre-set dates. With the guaranteed income option on a deferred annuity, you may be able to add a return of premium option; this option allows for return of premium if the annuitant dies before the annuity start date.

4. Impaired annuity option

Impaired annuities for people with health problems severe enough to affect their life expectancy. Income payments are higher than the standard life annuity and won’t decrease, even if medical advances improve the annuitant’s life expectancy.

5. Cash refund option

For life, and joint and last survivor annuities, you can opt to have a guaranteed payout of your original premium. If you die before the amount equal to your premium is paid to you, a cash payment equal to the difference of the two will be paid to your beneficiary.

An annuity solves longevity risk

According to Statistics Canada, a 65-year-old today can expect to live an average of about 20 more years, to age 85. But this is just an average, which means many can expect to live beyond age 85 including some who will die in their 90s and others who will reach age 100 and beyond.

Video | What is an annuity?

Male Annuity Rates

| Single life male annuity rate with no guarantee period. | |||||||

|---|---|---|---|---|---|---|---|

| Company | Age in Years | ||||||

| 60 | 65 | 69 | 70 | 75 | 80 | ||

| BMO Insurance | 470.46 | 538.56 | 604.56 | 624.30 | 737.77 | 882.31 | |

| Canada Life | 491.99 | 568.35 | 651.16 | 676.60 | n/a | n/a | |

| Desjardins Fin. | 489.69 | 562.38 | 638.31 | 660.22 | 780.29 | 909.24 | |

| Empire Life | 482.87 | 561.08 | 639.69 | 662.50 | 795.18 | n/a | |

| Manulife | 483.15 | 546.05 | 613.04 | 636.96 | 777.80 | 996.57 | |

| Standard Life | 432.47 | 502.06 | 576.97 | 598.97 | 729.41 | 915.37 | |

| Sun Life | 472.17 | 542.78 | 616.13 | 637.55 | 769.39 | 960.11 | |

Female Annuity Rates

| Single life female annuity rate with no guarantee period. | |||||||

|---|---|---|---|---|---|---|---|

| Company | Age in Years | ||||||

| 60 | 65 | 69 | 70 | 75 | 80 | ||

| BMO Insurance | 431.16 | 485.73 | 537.30 | 552.93 | 645.30 | 778.14 | |

| Canada Life | 422.70 | 489.05 | 549.94 | 569.27 | - | - | |

| Desjardins Fin. | 438.07 | 495.56 | 556.82 | 574.99 | 677.53 | 811.72 | |

| Empire Life | 439.07 | 497.86 | 558.63 | 576.68 | 686.92 | - | |

| Manulife | 450.00 | 499.22 | 553.42 | 572.91 | 687.60 | 861.14 | |

| Standard Life | 403.59 | 462.80 | 527.53 | 537.53 | 658.02 | 838.24 | |

| Sun Life | 434.71 | 493.34 | 553.28 | 570.77 | 679.42 | 839.94 | |

Joint Annuity Rates

| Joint life annuity rate with no guarantee period. | |||||||

|---|---|---|---|---|---|---|---|

| Company | Age in Years | ||||||

| 60 | 65 | 69 | 70 | 75 | 80 | ||

| BMO Insurance | 389.11 | 432.24 | 472.39 | 484.66 | 559.29 | 663.81 | |

| Canada Life | 363.86 | 436.27 | 482.97 | 494.66 | - | - | |

| Desjardins Fin. | 395.69 | 441.15 | 489.31 | 503.43 | 579.84 | 696.13 | |

| Empire Life | 393.21 | 435.07 | 478.57 | 491.57 | 571.54 | - | |

| Manulife | 395.95 | 431.95 | 469.59 | 484.50 | 569.27 | 696.93 | |

| Standard Life | 356.61 | 400.76 | 448.52 | 458.62 | 544.13 | 668.33 | |

| Sun Life | 389.42 | 435.62 | 481.81 | 495.30 | 574.34 | 689.04 | |

Companies that sell annuity products

- Assumption Life

- BMO Life insurance

- Canada Life Insurance

- Empire Life Insurance

- Equitable Life

- Foresters (was Unity Life)

- Industrial Alliance

- ivari (was Transamerica Life Insurance)

- La Capitale Insurance

- Manulife Financial

- Standard Life Insurance (now Manulife)

- Sun Life Financial

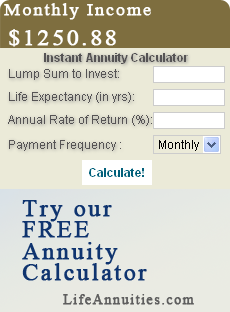

Annuity Calculator

The Annuity Calculator can help you estimate how much your monthly annuity payments could be.

Request an annuity quote

- Free, no risk and no obligation

- We do the shopping for you

- Annuity rates from top-rated insurance companies

- Customized annuity report

- Report delivered within 24hrs

- Annuity Quotes are emailed in PDF

- No unsolicited calls