TFSA: Tax Free Savings Account

TFSA (Tax Free Savings Account)

A TFSA is a product in which you invest tax-paid money. Any gain on your investment is tax free but there are limits on the amount you can invest each year. Contributions are cumulative, so you can make up any unused contribution room at any time. And you can deposit and withdrawal as frequently as you wish.

What is a TFSA?

The acronym TFSA ( Tax-Free Savings Account) isn’t a savings account in the traditional sense. Some people see TFSAs as a kind of basket - one in which you can add various financial instruments, including cash, bonds, stocks, GICs, and ETFs. TFSAs were introduced in 2009 by Canada’s government, which wanted to encourage its citizens to save their money. As tax is already paid on money deposited to your TFSA, no further taxes will need to be paid when the money is withdrawn.

TFSAs: How Do They Work?

TFSAs are simple. After a TFSA is opened up, you can deposit money you wish to save. TFSAs are very flexible with regard to withdrawals. In comparison to RRSPs, your money can be withdrawn whenever you want without consequence. However, there are limits mandated by the government on the amount that you can deposit to it each year. This “contribution limit” varies from one year to another. It is worthwhile to review what the limit is this year and contrast it to limits from years past. That is because you could be penalized for contributing too much – specifically 1% of any over-contributions per month until it has been withdrawn.

When withdrawing funds from your TFSA, any amount taken out will be added to the amount you are allowed to contribute in a subsequent year. You don’t have to worry about this contribution room disappearing if you don’t make any contributions during certain years. In such cases, it will simply roll over giving you contribution limits that are always expanding.

TFSA Advantages

TFSAs are sometimes called “tax-advantaged accounts” because the federal government offers this tax break. Consider maxing-out your TFSA returns for the sake of optimizing capital. All gains are tax-free, which makes it an unbeatable investment.

A TFSA is tax-exempt, incentivizing Canadian citizens to put away their money for large purchases (like a house) or retirement. Although TFSA contributions don’t come with tax breaks that can be used immediately (like an RRSP contribution), you’ll get significant breaks later on, because taxes will not need to be paid on any investment gains. To put it another way, because taxes were already paid on money deposited to your TFSA, nothing additional must be paid when the time comes to take that money out of it.

TFSA Limitations

A TFSA is capable of getting you into trouble if you are not careful with your contribution. Since TFSAs are quite plentiful and popular, there is no limit on the amount of accounts you’re able to open. However, you might start losing track of the amounts if you have multiple accounts. When you make over-contributions (depositing more money than legally allowed within a 12-month span), even by accident, a 1% penalty will be applied to the amount over the limit each month. Don’t forget – stocks sitting in a TFSA cannot be day-traded, a rule that is enforced by the Canada Revenue Agency.

Contribution Limits

The federal government changes TFSA limits from year to year.

What is the annual TFSA contribution limit for 2025?

The Tax-Free Savings Account (TFSA) contribution limit for 2025 is $7000.

2025’s Cumulative Contribution Limit

The cumulative contribution limit from 2009 to 2025 is $102,000.

Investment Options

TFSAs are essentially baskets into which you can put all sorts of investments. You might be interested in investing in real estate, bonds, or stocks.

TFSA Rules (Over-Contributions and Withdrawals)

There are a couple of things you should keep in mind:

- Refrain from over-contributing – doing so will result in a penalty of 1% on any excess contributions for each month until that deposit surplus is withdrawn.

- Be familiar with the contribution rules associated with TFSAs – if you intend to replace any funds that were withdrawn from a TFSA, you won’t be able to do so for one year after the withdrawal was made.

TFSA versus RRSP

Because both RRSPs and TFSAs are great options for reasons of their own, they do have some operation similarities, both positive and negative.

TFSA or RRSP?

If you are putting money away for retirement, and earn $50,000 or more each year, consider using RRSPs as an investment vehicle. A TFSA would be better suited for people who earn below $50,000, along with those who might have to withdraw funds before they retire.

If you are benefiting already from tax advantages with RRSPs, then it would do you well to capitalize on a TFSA.

Further, there are several other factors to keep in mind when you are trying to decide to go with either an RRSP or a TFSA:

- If you have not contributed very much toward your retirement, but can access large sums of money when needed - perhaps through an inheritance or bonus - then a TFSA may be the most suitable choice for you. That is because RRSPs have what is known as “annual deduction limits.” Also, contribution room isn’t cumulative. It does not roll over year by year. You do have the option to contribute fixed amounts to an RRSP – the CRA website will give you future, past, and current deduction limits.

- TFSAs were designed for easy accessibility prior to retirement. They are ideal for people with immediate goals, such as purchasing a car or house. Since their money is easily accessible, TFSAs will not be ideal for those who are easily tempted by random splurges.

- For tax purposes, if the money you are investing is for retirement, then a TFSA will be better than an RRSP, especially if you earn $50,000 annually or less.

TFSA Taxes

Although contribution and withdrawal rules are typically the most talked about aspects of a TFSA. While it remains tax-free, there are several instances where taxation on this type of account will be required.

For the most part, capital gains, interest, or dividends generated on TFSA investments aren’t taxable either while in an account or during a withdrawal. However, if your annual contribution room is exceeded, taxes will need to be paid on the TFSA surplus amount. A tax penalty of 1% will need to be paid on any excess amount in your TFSA. As an example, if your TFSA has $500 more than it is allowed to in September, and no steps are taken to rectify this issue until year’s end, you will end up paying a tax of $5 each month.

You might also need to pay tax on a TFSA if you are considered to be a “non-resident,” especially if any contributions were made to it. You will be subjected to a monthly tax of 1% on your contributions. You are considered to be a non-resident by the Government of Canada if you reside outside of the country for most of the taxation year.

Opening a TFSA

Canadians 18 years old and up can open a TFSA if they have a valid SIN (Social Insurance Number). Simply get in touch with an insurance company, financial institution, or credit union that offers TFSAs. You may be asked for supporting documentation – such as a passport or birth certificate – in order to verify your identity. This is a process that takes 10 minutes or less to complete. There is no shortage of institutions that allow you to open up a TFSA. Keep your eye out for one that doesn’t ask for a minimum investment, offers unlimited customer service from industry experts, and who charges reasonable rates.

Transferring Your TFSA

Switching from one bank to another is simple. A fee might be involved to transfer your TFSA, though the new bank or financial institution might reimburse you. It is worthwhile to verify this so that you know what charges to expect. With that said, when the transfer has been authorized, you may be asked if you want the account transferred either “holdings as is” or “as cash.” Based on what kind of investments you are holding, there may be fees involved with taking one instead of the other.

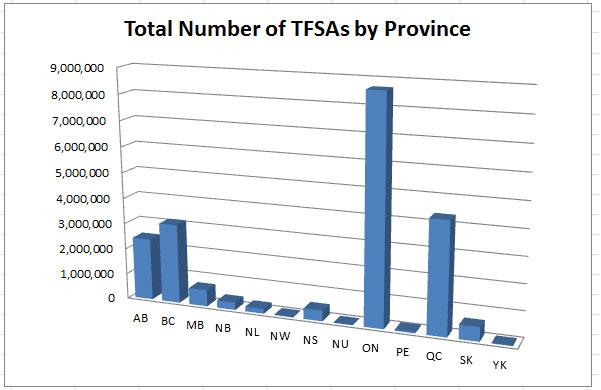

Canadian Attachment to TFSAs Increases

Canadians held almost $300 billion in TFSAs at the end of 2018, the most recent year for which the Canada Revenue Agency publishes statistics.

Table: TFSA Holders by Province

| Province | Total number of TFSAs |

|---|---|

| Alberta | 3,236,700 |

| British Columbia | 4,272,640 |

| Manitoba | 848,690 |

| New Brunswick | 389,470 |

| Newfoundland and Labrador | 243,230 |

| Northwest Territories | 24,810 |

| Nova Scotia | 562,820 |

| Nunavut | 10,530 |

| Ontario | 11,738,520 |

| Prince Edward Island | 83,460 |

| Quebec | 5,967,700 |

| Saskatchewan | 682,620 |

| Yukon | 27,480 |

| Total | 28,223,330 |

*Data courtesy of Canada Revenue Agency. TFSA 2024 Statistics (2022 contribution year).

What Happens When the TFSA Holder Dies?

If a beneficiary was designated by the account holder, the beneficiary will receive the TFSA, along with all holdings it contains. This is applicable to successor holders, children, common-law partners, and spouses. Income that is earned right after the initial holder’s demise will continue to be protected from taxes, as will the newfound successor holder. For instance, if your spouse owns a TFSA containing $20,000 and $1,700 was earned during the duration between their demise and settling of the estate, the $21,700 total will stay tax-free, as will any income that is earned on it.

With that said, if any excess contributions were made to the TFSA when the account holder died, things get slightly more complicated. As an example, if your partner had $5,000 more than they were allowed to in their TFSA when they died, if you are named as the successor’s buyer partner, then that $5,000 excess contribution will be transferred to your TFSA automatically. If contribution room is something you have, then you will be fine. However, if the extra $5,000 puts you over the annual contribution allotted, then you’ll be subjected to a monthly tax of 1% for the duration that the surplus funds remain in the account.

Who is allowed to make contributions to TFSAs?

To open up a TFSA a valid SIN will be necessary. The minimum age to open up a TFSA is 18. As an account holder, you will be the sole individual allowed to make withdrawals and contributions. You’ll also be in charge of how funds are invested.

Are limitations cumulative in a TFSA?

Contribution limits are essentially the maximum that you are allowed to deposit to a TFSA annually and accumulate each year automatically. You have the ability to withdraw funds from a TFSA whenever you want. Just be mindful that whatever is withdrawn will get added to the yearly contribution room allowed.

How Much Contribution Room Will I Have?

The contribution limit this year, along with any contribution room from years past that remains unused. The yearly contribution room for 2025 is $7000. Your personal contribution room may be established by the yearly dollar limit ($7000, in this scenario). It includes unused contribution room stemming from the prior year, along with withdrawals that were made from your TFSA that previous year as well.

How can TFSA contributions be claimed on my income tax return?

TFSA contributions aren’t tax-deductible and cannot be claimed on your income tax return as they are exempt from taxes already. TFSAs are meant to grow without being taxed, as opposed to allowing you to deduct contributions on a tax return.

Can TFSAs serve as emergency funds?

Yes, they can. The funds will not be subjected to taxes, and you will not be charged for any withdrawals. Be mindful of contribution limits, though. If any withdrawals are made from your account, you will not have the ability to re-deposit those funds right back into the TFSA again for another year. Assuming that you don’t exceed your contribution limits, your TFSA will be able to hold an emergency fund. With that said, TFSAs are typically used alongside RRSPs for the sake of creating retirement funds, as well as to put money away for a large purchase in the future.

Some friendly advice – it would be worth your while to hold onto emergency funds inside cash savings, as opposed to investments. You should have the ability to access money anytime you are in need of it. This can stop you from withdrawing during market dips. Consider putting emergency funds inside some type of savings account. The TFSA should be used for savings goals of a long-term nature.

Can TFSAs be used to put away money for vacations?

Of course! However, when money is withdrawn, it cannot be re-contributed until one year later. If you are interested in taking a vacation, then savings may be the better option. On the other hand, if you are putting away money for a lifetime vacation ten years into the future, then think about investing your money instead. Your decision should revolve around your personal situation.

Is maxing-out a TFSA worth it?

Assuming you have some type of emergency fund elsewhere, nothing is stopping you from maxing out the TFSAs you own. If you’re able to do it without financial stress, all of the contribution space available should be filled up. Doing so can help you capitalize on all of the tax benefits that come with TFSAs. Keep an eye on the contribution room, though. Do not over-contribute during the calendar year that you make a withdrawal if you plan on re-depositing your money.

Will I lose any money by holding a TFSA?

The answer is contingent on many factors. Cash inside of savings accounts and term deposits will be covered to a maximum of $100,000 by the CDIC (Canada Deposit Insurance Corporation). Investments aren’t covered by them, though. When dealing with an investment of any sort, the risk of potentially incurring losses is always on the table. Based on the kind of investment your TFSA is holding, a loss may be incurred on the original investment. Be mindful that investment losses inside of a TFSA will not be seen as a withdrawal. Therefore, they will be a part of the contribution room you have in your TFSA. If it’s holding mutual funds, GICs, bonds, and stocks, then the CDIC will only cover the GIC.

Is there a limit on the number of TFSAs that an individual can have?

There is no cap on the number of TFSAs that can be opened, but you should be careful. The total amount of contribution room you are allocated will be no different than if you had a single account. As such, if 2025’s contribution room was $7000 for you, then your total contribution room will be $7000, regardless of how many accounts you have. Multiple TFSAs make it difficult to monitor your contributions.

Is there such a thing as a joint TFSA?

There is not. You will be the exclusive holder of the TFSA account you own. That is because each individual has contribution limits of their own. Your limits cannot be integrated with other people’s. You do have the ability to designate successor holders and beneficiaries to a TFSA, though.

Will a TFSA be considered collateral against loans?

Assets inside TFSAs can indeed be utilized as a form of collateral against loans. For example, you can use a TFSA to secure your mortgage. A stipulation may be included that prevents you from withdrawing funds out of your TFSAs until your loan is completely paid off.

What to do now?

- We supply you with the best TFSA interest rates and other eligible investments in Canada as our brokers represent all the best financial institutions in Canada. For personal assistance on your TFSA please use our TFSA Form.