How Do I Apply For An Annuity Policy?

6 Simple Steps on How to Apply for an Annuity Policy

- Consider the following questions before applying for an annuity:

- Will the life annuity be a single life or joint life?

- Will there be a guarantee period?

- Payment frequency?

- When is the purchase date & start date?

- Are the funds registered or non-registered?

- Get Comparison Annuity Quotes

- Review Your Quotation

- Lock-In the Rate Guarantee

- Complete The Documents

- Life annuity application

- Annuity illustration

- Cheque payable to the insurance company (for non-registered funds)

- Transfer form(s) for registered funds (i.e. T2033)

- Void cheque for automatic deposit

- Photo I.D.

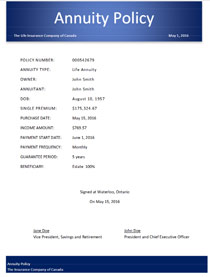

- That's It! - Receive Your Policy By Mail

Will the life annuity be for yourself or will it include your spouse?

You have the option of choosing no guarantee on your life annuity or you can choose the most common 10 year guarantee. In most cases the longer the guarantee the lower the annuity income. The guarantee period for registered life annuities is to age 90. For example if your current age is 65, your maximum guarantee can be 25 years.

Would you like to receive your life annuity income, monthly or annually?

When would you like to purchase the annuity and when would you like to start receiving the income payments? Usually purchase date and income start dates are the 1st and 15th of each month.

Are registered or non-registered funds to be used in the purchase of this life annuity?

In order to get the best possible income you need to compare quotes from all the life insurance companies in Canada. You can shop the market by completing our Life Annuity Quotation Survey.

Review your quotes with a independant annuity broker who can give you unbiased advise. He can customize your annuity to meet your needs by adjusting the guarantee period, indexing it to inflation or including your spouse in a joint policy

After you decided on the insurance company, request a rate guarantee to lock-in the rate.

The insurance company will then request the following items:

The insurance company will then issue your life annuity policy.

Because we are independent we do not promote any particular insurance company. You choose the company you want, which is usually the company offering you the best annuity income.