Prescribed Annuities Tax Changes

Best Buy Before Date January 1, 2017

Avoid The Tax Changes Before January 1st, 2017

If you want to avoid the 2017 tax rule changes for non registered annuity payments, you need to buy before January 1, 2017 rolls around. The countdown to January 1, 2017 has begun, when prescribed annuities tax changes take effect. The taxable portion will result in higher taxation, so you need to move now to beat the clock.

What is actually happening is that the federal government tax changes, made under the income tax act, are increasing due to the discarding of the 1971 life expectancy tables.

There will be grandfathering for those who do not want to commence payments until 2017, so it is apparent there are great benefits in annuitizing before January 1, 2017.

What you need to know

The increased taxation rules for non-registered prescribed annuities contracts comes into force on January 1, 2017.

Effective January 1, 2017, the formula for calculating the taxable portion of prescribed annuities will be changing

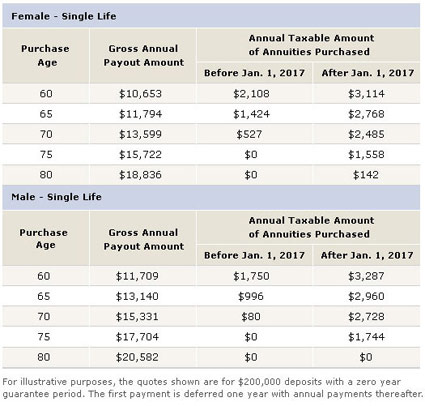

View the taxation table below for examples of the increased taxation you will pay if you do not purchase before that date.

Annuities purchased on or before December 31, 2016 will benefit from a grandfathering provision.

You can commence income in 2017 or later and still qualify for the 2016 rates.

About prescribed life annuities

In exchange for a lump-sum premium, an insurance company guarantees to pay you a fixed monthly income for your lifetime.

- Offers higher income and lower tax than a GIC.

- Peace of mind with no risk as with investment funds.

- Guaranteed income for your lifetime