5 Annuity Quote Examples

Company annuity illustrations

How does an annuity work?

An annuity is a guaranteed stream of payments that will provide you with a regular income for your lifetime. You, nor your spouse if included, can outlive the income.

Below are 5 annuity illustration examples provided by the insurance companies.

- Annuity Example of a Single Life Male

- Annuity Example of a Single Life Female

- Annuity Example of a Joint Life

- Annuity Example of a Joint Life

- Annuity Example of a Joint Life

Personal Information

Personal Information

The annuitant is a male aged 68 years old. He is currently retired.

Source of Funds

Source of Funds

The annuitant lives in the province of British Columbia and has a RRSP account with TD Waterhouse. He does most of his investment transactions online. He has now transferred his stock into cash to purchase a life annuity.

General Information about the Contract

General Information about the Contract

The annuitant purchased a single life annuity with $147,000 from Industrial Alliance Insurance. The life annuity will provide a monthly income of $825.44 for his lifetime, he will never be able to outlive the income. The life annuity income will help cover his fixed costs such as food, rent, electricity in his retirement.

Annuity Illustration from Industrial Alliance

Annuity Illustration from Industrial Alliance

Prepared on: June 25, 2015

Company: Industrial Alliance

Type of annuity: Single Life, providing income for life

Guarantee Period: 5 years

Annuitant: Male, 68 years old

Jurisdiction: British Columbia

Source of funds: RRSP

Premium: $147,000

Monthly Income: $825.44

Annuity Illustration: View and print annuity quote

Personal Information

Personal Information

The annuitant is a female aged 60 years old. She is in her pre-retirement phase.

Source of Funds

Source of Funds

The annuitant lives in the province of Ontario and has a RRSP account with the BMO InvestorLine. She is looking to transfer her funds into the money market to purchase a life annuity.

General Information about the Contract

General Information about the Contract

The annuitant purchased a single life annuity with $95,750 from Standard Life Insurance. She has several guarantee options to choose from but ultimately choses a 10 year option. The life annuity will provide a monthly income of $413.34 for her lifetime, she will never be able to outlive the income. Any remaining guaranteed payments at her death, are valued at a present day amount, taxed and the balance distributed to the heirs.

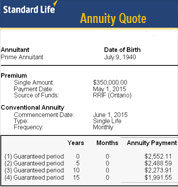

Annuity Illustration from Standard Life

Annuity Illustration from Standard Life

Prepared on: May 15, 2015

Company: Standard Life Insurance

Type of annuity: Single Life, providing income for life

Guarantee Period: 10 years

Annuitant: Female, 60 years old

Jurisdiction: Ontario

Source of funds: RRSP

Premium: $95,750

Monthly Income: $418.55

Annuity Illustration: View and print annuity quote

Personal Information

Personal Information

The prime annuitant is a male aged 71 and the secondary annuitant is a female aged 60 years old. Both annuitants are retired.

Source of Funds

Source of Funds

Both annuitants live in the province of Ontario and he has a RRSP account with the TD Canada Trust. His funds have been transferred into cash to purchase a joint life annuity which they will never outlive.

General Information about the Contract

General Information about the Contract

The annuitants purchased a joint life annuity with $500,000 from Sun Life Financial (Money for Life). The life annuity will provide a monthly income of $2377.61 for their lifetime, and 20 years in any event. If one annuitant dies, the other will continue receiving a monthly income until their death.

Annuity Illustration from Sun Life Financial

Annuity Illustration from Sun Life Financial

Prepared on: June 23, 2015

Company: Sun Life Insurance

Type of annuity: Joint Life, providing income for life

Guarantee Period: 20 years

Annuitant: Male 71 years old, Female 60 years old

Jurisdiction: Ontario

Source of funds: RRSP

Premium: $500,000

Monthly Income: $2377.61

Annuity Illustration: View and print annuity quote

Personal Information

Personal Information

The prime annuitant is a male aged 65 and the secondary annuitant is a male aged 65 years old. Both annuitants are retired.

Source of Funds

Source of Funds

The annuitants live in the province of Ontario and the prime annuitant has a RRSP account with the Standard Life Insurance. The annuitants are looking to transfer the funds into the money market while awaiting the purchase of a joint life annuity.

General Information about the Contract

General Information about the Contract

The annuitants purchased a joint life annuity with $250,000 from Canada Life. The joint life annuity will provide a monthly income of $1163.62 for their lifetime, which they will not outlive.

Annuity Illustration from Canada Life

Annuity Illustration from Canada Life

Prepared on: June 16, 2015

Company: Canada Life

Type of annuity: Joint Life, providing income for life

Guarantee Period: 20 years

Annuitant: Male 65 years old , Male 65 years old

Jurisdiction: Ontario

Source of funds: RRSP

Premium: $250,000

Monthly Income: $1163.62

Annuity Illustration: View and print annuity quote

Personal Information

Personal Information

The prime annuitant is a female aged 59 and the secondary annuitant is a female aged 60 years old. Both annuitants are approaching retirement.

Source of Funds

Source of Funds

The annuitants live in the province of Ontario and the prime annuitant has a RRSP account with Questrade. The annuitants are looking to transfer all of the funds into cash to purchase a joint life annuity.

General Information about the Contract

General Information about the Contract

The annuitants purchased a joint life annuity with $100,000 from Transamerica Life Insurance. The joint life annuity will provide a monthly income of $318.58 for their lifetimes.

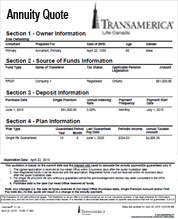

Annuity Illustration from Canada Life

Annuity Illustration from Canada Life

Prepared on: June 19, 2015

Company: Transamerica Life Insurance

Type of annuity: Joint Life, providing income for life

Guarantee Period: 10 years

Annuitant: Female 59 years old, Female 60 years old

Jurisdiction: Ontario

Source of funds: RRSP

Premium: $100,000

Monthly Income: $318.58