Using a Retirement Calculator To Plan Your Retirement

A retirement calculator can ease the stress of trying to figure out what you'll need to retire

Planning for retirement can be both a joy and a source of stress. On the one hand, you look forward to the day you don't have to deal with the hassles of work and you can live the life of leisure. On the other hand, you may be worried about whether or not you'll have enough money to live comfortably, take care of your medical needs, and maybe travel to places you always wanted to go but could never find the time. Luckily, there is a very handy tool for those of us who have retirement looming in the not so distant future: a retirement calculator. This tool can go a long way in easing the stress of trying to figure out what you'll need to retire in the way you want.

AARP'S Retirement Calculator

How much money will you need to retire?

About Retirement Calculators

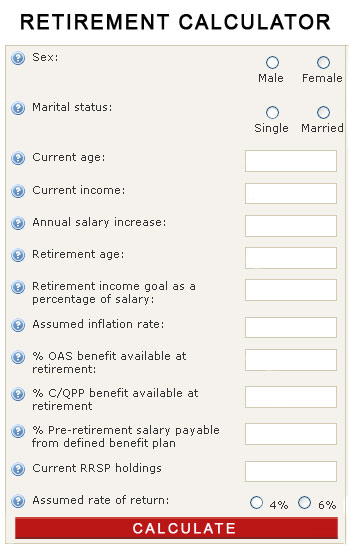

Retirement calculators allow you to put in various variables to determine if you are on the right track to retire with the lifestyle you desire and at the age you want as well.

These factors include:

- Sex

- Marital Status

- Your current age

- Your current annual income

- Annual Salary Increases

- Your desired retirement age

- The amount of money you have already saved for retirement

- The percentage of your income that you save for retirement

All retirement calculators make certain assumptions and it's important that you know exactly what those assumptions are to determine how valuable the information they provide will be for you. For example, many simple calculators will assume a certain rate of return on your retirement account, usually 4 percent. However, others will have a default rate of return but will also allow you to modify this rate.

Most calculators will also assume that you receive a certain increase in salary every year. If this is not realistic for your situation, you may want to find a calculator where you can change this factor. You also need to realize that retirement calculators do have one major limitation: they cannot predict unexpected factors that could significantly affect your retirement.

For example, your marital status may change. If you are married, you automatically receive a larger benefit, but if you divorce your spouse, your benefit will go down. You may also receive a large promotion and have your salary level jump. On the other hand, your company may downsize and force you into early retirement, or worse. You could also have a car accident and need to go on disability. In other words, it would be a wise idea to develop contingency plans as you work through the calculations and not put all your eggs in one basket. Try to look at best case and worse case scenarios.

Experiment

It can be a highly useful exercise to experiment with plugging in different values into the retirement calculator. For example, you can try putting in different ages for your age of retirement and see how this affects the style in which you could retire. You may determine that you can retire earlier than you originally thought. However, you may also discover the inconvenient truth that if you don't change your rate of savings or find a new job that pays more, you will have to work into your seventies to retire comfortably. In fact, this can be one of the most valuable lessons a retirement calculator can provide since it is better to find out that you are not saving enough for retirement before it is too late to do anything about it. You may also find that you would have enough to retire on at your desired retirement age but not in the lifestyle you had hoped for. This may prompt you to start adding a bit more to your retirement fund. Of course, these calculators can also help you determine how much more you need to add in this situation.

Practical Returns

There are practical concerns that may affect how you evaluate the information you deduce from such a calculator. For example, most retirement calculators will assume you will live to a certain age such as age 82. However, some people live well beyond this age. In many cases, when an individual lives into their 90s, they need a lot of extra care. In fact, you have to face the fact that you may end up needing around the clock care in your last years. You may want to consider how long your parents, grandparents, aunts, uncles, and other relatives lived to estimate your own longevity, keeping in mind this is not guaranteed.

Health

While everyone can have unexpected medical expenses in retirement, you may also want to take into account your current health issues and those of your family. Does heart disease or cancer run in your family? Do you currently have diabetes, high blood pressure, or another disease that could affect both the length of your life and the quality of your life in your later years? These can be hard realities to cope with but for most people, planning ahead, using a calculator as an aid, can reduce their stress leading up to retirement and during retirement as well.

One of the biggest advantages of using a retirement calculator is that they can help you gain a more practical perspective on where you are headed. It would be fabulous if we could all retire young and live like kings and queens but the reality is that most of us cannot do so. In some cases, we may be living it up a bit too much now and robbing ourselves the chance to retire in comfort and security. Some may be taking vacations that are too extravagant, buying fancy cars they really don't need, and paying for expensive home remodel projects they could easily live without. Using a retirement calculator can identify this problem in black and white and inspire us to think more about the future and the changes we need to make now to retire well in the future. Retirement calculators are one of the most valuable tools you can use when planning your retirement. However, they should be balanced with other considerations. It would also be prudent to retire with more than what you think you may actually need. You can always leave any extra to your children and grandchildren. You can even have a lawyer spell out exactly how you want your children to use your money. In this way, you can take comfort in knowing for sure you'll have enough resources in retirement and you'll be leaving a legacy for future generations as well.