In Canada, Annuities Make Sure Retirees Do Not Run Out Of Money

More baby boomers in Canada are embracing annuities.

What do retirees fear the most in retirement?

Many Canadian retirees will tell you that the fear of of running out of money during their retirement years makes them extremely nervous. This is why numerous baby boomers in Canada usually embrace annuities in order to be sure they've got enough funds to help them through their retirement years.

In Canada, annuities are sold by life insurance companies; however not all life insurance companies sell annuities.

Which Companies Sell Annuities In Canada?

The companies that sell annuities in Canada are

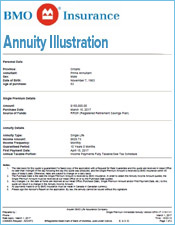

- BMO Insurance

- Canada Life Insurance

- Empire Life Insurance

- Great West Life

- Industrial Alliance

- ivari

- La Capitale

- Manulife Investments

- RBC Insurance

- Sun Life Financial

Where Do You Buy Annuities in Canada?

Since insurance companies do not sell annuities directly to the public, retirees need to find a life insurance agent acting for the insurance company or preferably a life insurance broker who specializes in annuities. Why a life insurance broker? An insurance broker will act independently and act in your best interest. A broker will represent more than on company hence offering you competitive annuity quotes from several companies.

What type of annuity should I buy?

There are 3 different types of annuities sold in Canada

- Single Life Annuity (with or without a guarantee period)

- Joint Life Annuity (with or without a guarantee period)

- Term certain Annuity

A single life annuity provides an income as long as the annuitant is living.

If a guarantee period is selected, and the annuitant dies before the end of the guarantee period, the income will continue to the beneficiary.

This type of annuity provides an income during the lifetime of two people, first on the life of the primary annuitant, then on the life of the successor annuitant.

Again, If a guarantee period is selected, and the annuitant dies before the end of the guarantee period, the income will continue to the beneficiary in case of a non-registered annuity.

A term life annuity provides the annuitant with guaranteed, regular income for a selected period of time. Income payments cease and the annuity contract ends at the end of the term certain period.