Canadian Variable Annuity

Select which variable annuity in Canada you want.

Many choices of funds for investment in Canada

You have many choices of funds for investment in Canadian variable annuities, ranging from small cap equities to bonds and dividend funds.

Since the 2008/2009 market breakdown, many investors have shied away from risky stock market investments, preferring to invest in a Canadian variable annuity with conservative bond and dividend funds for regular monthly revenue.

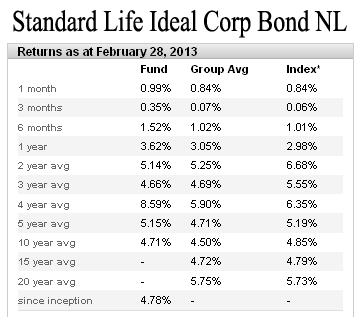

Let's say you want a regular monthly income on which you can rely but you don't want to buy a life annuity as you think life annuity rates will go up later. The answer to the problem is a variable annuity from which you take a certain dollar amount monthly or a certain percentage of value. For this purpose you choose a conservative government and large corporate bond fund consistent 5 or 10 year return such as the following:

Once your payments start, you can fine tune the amounts to suit your lifestyle, putting you in full control of your income.