Buying an Annuity with a T2033 Transfer Form

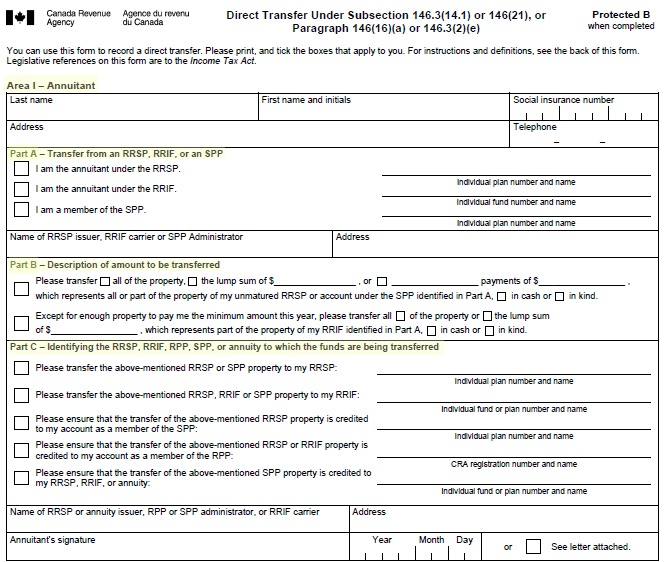

T2033 Transfer Form

Are you buying an annuity witha T2033 transfer form?

If you are buying your annuity or transferring your RRSP or RRIF using the government T2033 transfer form, you need to be careful that it is properly completed.

What is a T2033 Transfer Form?

This exciting number is the name of a transfer form you need to fill out to transfer RRSP funds between two institutions (say, you're changing stockbrokers, or you want to move your GIC to a mutual fund at a new company) without having to deregister the funds.

Download The T2033 Transfer Form

File format pdf

File size: 271 kb

No. of pages: 5 pages

Download fillable pdf: ![]() T2033

T2033

3 Common Mistakes

There are 3 problems that frequently repeat when it comes to completing these transfer forms correctly.

1. The first problem is the correct address of the holder of the RRSP or registered funds. We have encountered situations where some financial institutions prefer to have the head office address on the form while others prefer the local branch office. To solve this problem, we mostly put the branch address on the T2033 but sent it to the head office.

2. The second problem is that some clients hold stocks and bonds in their portfolio which they want to keep and do not want transferred. We have tried with no great success, to add these "DO NOT TRANSFER" messages on the T2033 itself. So we now advise our clients to open a new RRSP account with the same firm to hold the stocks and bonds he or she wishes to retain.

3. The third problem is the timing of the transfer. If you sign it on day 1, it will take 2/3 days before it arrives in the correct office for handling by the transferor.

Then in turn, each T2033 is matched with the investment or investments for validation, a process which can take another 7 days or so. Then notification is sent to the transferee or receiving company, that the funds of $xxx are available. Of course, this only takes place after the salesman at the transferor company has been notified of the impending transfer and given a few days to try and retain the funds. Learn how to complete a T2033 Transfer Form.

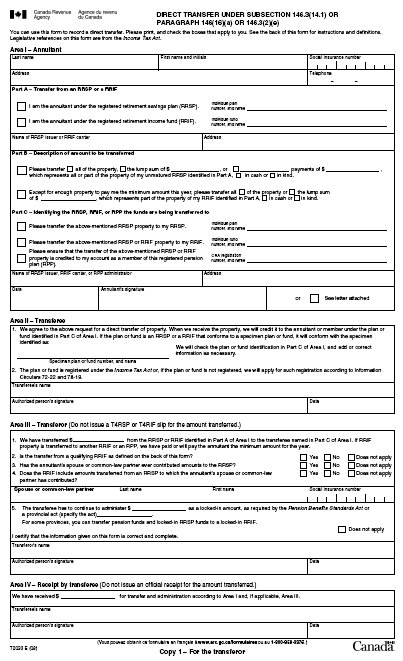

Sample of a T2033 Transfer Form

Transfers can take up to 4 weeks

All these hurdles take time and 3 to 4 weeks is the normal time it takes before the transferor finally sends the cheque to the transferee or the insurance company that is issuing the annuity. Most companies will give you 45 days to have the funds actually transferred so that your monthly income figures does not change. And that figure of 45 days or 6 weeks confirms the long delay.

Recently the writer handled a case involving a transfer from TD Waterhouse which took X days to complete despite many entreaties from us and the clients themselves.

So be warned that the situation is not getting better as the companies seem to be cutting down on staff, the same problem you see in the branches themselves and this is normal. For the period of September to December you can safely add another 1 or 2 weeks at least.

Have an experienced company complete the T2033

These are the reasons we complete the T2033 transfer form ourselves; we know the problems and how to avoid them.

The best way to approach the T2033 transfer problem is to conscentrate on the income date.

Say you want payments to start October 1st. Then concentrate on having cash only in your account as early as possible. Obviously this does not apply to some registered transfers but it does apply to banks and financial firms.