Annuity Calculator

Canada's Annuity Calculator

Our annuity calculator shows how much monthly annuity income you can get.

A lifetime income annuity can be just the ticket for providing you with the confidence and piece of mind so that you will never be faced with the frightening prospect of outliving your savings – no matter how long you or your spouse should live.

About the annuity calculator

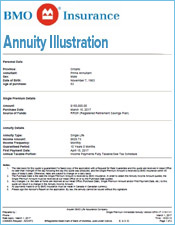

Our online annuity calculator is an essential tool to help you estimate just what how much guaranteed income your nest egg can generate if you locked in your income today. If you are still away from retirement, our online annuity calculator can help you estimate how much of a savings cushion you will need in order to generate a given income level – assuming today’s interest rates.

We work with annuity clients every day to help them plan through the key aspects of retirement income and life insurance planning. A big part of our practice is helping our clients generate a guaranteed income – for life!

What is a life annuity?

A life annuity is simply a contract an individual makes with a life insurance company. In exchange for a lump sum, or premium, you will receive a set and constant income for life – guaranteed. No matter what the stock market does, no matter what the property market does, no matter what happens to interest rates, you will receive the same annual or monthly income for as long as you live.

How do I determine my monthly income payments using the annuity calculator?

Our online annuity calculator is designed to be easiest and most intuitive calculator in use today. So we’ve made determining your guaranteed monthly income stream from a life annuity very simple: Just enter your personal details into the calculator above. You’ll need to key in the amount you plan to pay in premiums, your sex and age, and you’ll get an instant readout of what you can receive, every month for the rest of your life, guaranteed.

Note: The field “Type” should read “Single Life Annuity.” This is a lifetime income annuity that uses your life expectancy alone to calculate your payments. If you want to use your life expectancy, together with the life expectancy of your spouse or other designated individual to calculate your annuity benefits, call us at 888-970-1470, toll free for a custom quote! See below for more information. The field “Amount” is preset to $100,000. This makes other amounts easy to calculate by hand. The guaranteed annuity income quote you will receive will be your monthly income per $100,000.

Note that the older you are, the greater your guaranteed monthly income from a lifetime income annuity will be. Likewise, the younger you are, the lower your monthly income will be – but you are likely to receive those payments for a larger number of months!

Should I Include my partner/spouse in my annuity calculations?

If you have a spouse or partner who is dependent on your income, you may want to consider a joint life, or joint and survivor annuity. These annuities will continue after your death, or after your partner or spouse’s death, to benefit the survivor. That is, a joint life annuity provides guaranteed income, for life, for both of you, no matter how long either one of you should live.

Unless special circumstances apply, almost all of our clients who are married couples or otherwise in lifetime partnerships choose to use joint life annuities to secure a lifetime of income for both individuals.

There are some circumstances where they may make other choices, including just purchasing a single life annuity on one partner or the other:

- One partner may have a government or corporate pension, and they decide they want the higher income available by naming the partner not covered by the pension as the annuitant with a single life annuity. This way, if the pensioner dies, the survivor will receive the higher payments under the single life annuity, rather than the lower payment he or she would receive had they used a joint life annuity from the beginning.

- In some cases, there may be a large life insurance policy in place – sufficient to fund a sizeable annuity in the event of the death of the insured. This could affect your decision to include both spouses on the annuity.

In these cases, we recommend engaging a licensed life annuity and life insurance expert, and doing some calculations that are very specific to your situation. The life annuity calculator is an important tool in projecting how much income you may receive under various scenarios.

Should I start my life annuity payments now?

One approach to start your life annuity payments is to use the annuity payments to meet a specific need. The longer you wait, and the older you are when you begin taking income from your annuity, the greater your monthly cheque should be.

However, since the stream of income from a life annuity stops at death (or, the end of the guaranteed period after death) the longer you delay, the fewer payments you are likely to receive. However, many of our clients don’t wait until they absolutely need their annuity income.

Sometimes they simply don’t want to have to worry anymore, and choose to start their life annuity income early, for the sake of their peace of mind. You may choose to start your guaranteed income stream early, for example, if any of these circumstances apply:

- You want to reduce or eliminate stock market risk

- You want to lock in a minimum monthly income to pay for basics in retirement, and invest the rest

- You want to reduce or eliminate interest rate risk

- You want to reduce or eliminate inflation risk (if you choose an annuity with an inflation factor

- You want to protect non-registered funds against the claims of potential creditors

- You simply want to embrace a more conservative and less risky financial and investing strategy

Do I Need Guarantees?

The lifetime income annuity is, at its heart, an insurance product – not an investment product. As such, it is a valuable tool for reducing one of the most terrifying risks Canadian retirees face: The possibility of living longer than one’s retirement funds can support.

Life expectancy in Canada is growing fast: The average Canadian man can expect to live to age 80, and the average woman can expect to live to age 84. And those numbers are growing fast.

Those life expectancies are averages, of course. Many Canadians approaching retirement today will live beyond those ages. The reality is that most Canadians must confront the possibility that they will live to age 90, 95 and beyond. Mortality tables have just been updated to reflect this new condition.

This means that just as Canadians often buy life insurance to protect their families against the risk of the premature death of a breadwinner, Canadians should also consider using a lifetime income annuity to protect themselves and their families against the terrifying risk that they will live too long – far beyond the capacity of investments to support them. The lifetime income annuity provides a contractual guarantee that your promised stream of income will never run out, as long as you live, regardless of what the stock market or bond markets do. The life annuity essentially functions as longevity insurance.

A Life Annuity Is Guaranteed For Your Lifetime With No Possibility of Outliving It

Understand that no other financial product can provide the same guarantee that a life annuity can provide. No mutual fund, stock, bond, money market or other security can provide you a written guarantee that they will provide a specific level of income, for as long as you live, regardless of market conditions.

Only a life annuity can do that.

Do you need the guarantee? Most people do need the guarantee, if the risk of otherwise outliving their income is a gamble they cannot afford to lose.

At a minimum, we recommend covering your critical, basic income needs with guaranteed sources of income. That is, via strong pensions and with annuities from solid, reputable life insurance companies. This means that your combined income from guaranteed pensions and your income from life annuities should at least be sufficient to meet your basic needs for shelter, food, utilities, clothing and transportation for both yourself and your significant other.

Of course, you can always guarantee more. But using the life annuity calculator on this page as a guide, you will be able to calculate roughly how much you will need to deploy into a life annuity in order to generate your minimum income needs, and work from there.

You may have some non-guaranteed funds, apart from registered retirement accounts, that remains invested in the stock and/or bond market, to provide potential for growth in the future, and to provide a hedge against inflation.

Examples of non-guaranteed investments include the following:

- Mutual funds

- Stocks

- Rental properties/real estate

- Closely-held small businesses

- REITs (real estate investment trusts)

- Master limited partnerships

- Preferred stock

- Convertibles

- Closed-end funds

- Exchange-traded funds (ETFs)

- Government bonds

Each of these non-guaranteed investments has their place, in certain circumstances. But none of them can guarantee a given income for as long as you live. All of them have some element of stock market, inflation or other economic risk. You cannot count on income from these investments to pay out the income you need to meet your basic monthly needs.

Non-guaranteed sources of income such as these may be better places to store wealth that you may want to pass on to your heirs. Annuities are superior tools for guaranteeing you cannot outlive your income, and are good at transferring wealth to spendrift heirs.

Who should I call to discuss my lifetime income and other financial needs?

Visit us at LifeAnnuities.com to calculate and discuss all your life annuity and other retirement income and planning needs. Use our toll-free number, 1-888-970-1470.

Our exclusive network of experienced, knowledgeable, licensed insurance and financial professionals will be happy to work with you to develop a detailed plan to help you achieve the maximum financial security possible -- on a guaranteed basis.

Best of all, our services are free. You pay no fees and are under no obligation. Our fees are 100 percent paid by the annuity companies and other carriers we represent.

LifeAnnuities.com has been providing expert advice to families and businesses throughout Canada for over 44 years. We have been online since 1999. Our advisors are independents. That is, they are not captive agents who can only sign people up for one or two annuity carriers. Instead, our agents are fully independent, and can sign you up with any major, reputable insurance company doing business in Canada. This is important, because choosing the right annuity can mean a difference of 10 or even 20 percent in your monthly income, depending on your age and sex.

To save time, consider using our online quote generator. In just a few minutes, you can generate up-to-date quotes from dozens of reputable carriers – so you can choose the best life annuity for you.

If you have any unusual or pertinent medical history that could affect your life expectancy, please let our advisor know as well, as this could affect your choice of annuity.

The benefits of life annuities are many:

- Your income is guaranteed…for life!

- Optional additional guarantee that income will last for the life of you or your significant other – whoever passes away last.

- Protection from stock market volatility

- Protection from interest rate volatility

- Protection from future creditors and bankruptcy proceedings

- Enjoy your income. You don’t have to be afraid to spend money to enjoy life.

- Inflation protection – Choose from several possible cost-of-living protections or riders.

- Flexibility – Choose between a single life annuity, a joint and last survivor annuity, or a period-certain annuity.

- Choose from a monthly, quarterly or annual guaranteed income.

- Death benefits for heirs – Some annuities offer a rider that will provide a cash payout to surviving heirs under certain circumstances.

If you want a guaranteed lifetime income that you can never outlive, no matter what happens in the markets, the commitment is well worth it.

How To Sign Up for a Life Annuity

Again, if you have questions, or if you’re ready to move forward, call us today at toll free 1-888-970-1470, or fill out our annuity quote form. You will be promptly contacted by one of our professional advisers, who will work with you to determine and help you execute the best possible strategy for you.

Thank you for reading, and we look forward to working with you.